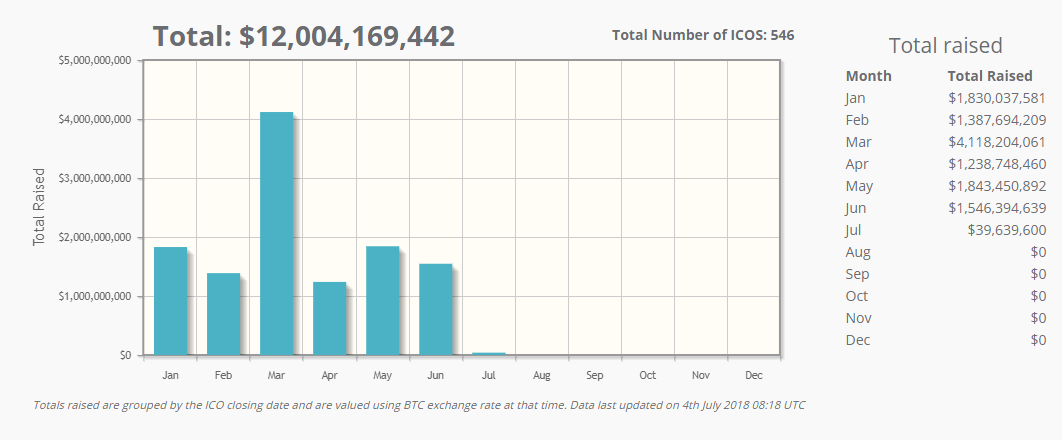

Though cryptocurrency prices have plummeted since the beginning of 2018, the slowing momentum hasn't stopped initial coin offerings (ICOs) from being introduced. According to statistics compiled by CoinSchedule, to date in 2018 there have been 546 ICOs so far, for a total of a bit more than $12B in capital raised.

For many, the allure of getting into the digital coin market early and riding the next potential Bitcoin higher still has significant appeal. And who can blame them. For investors who got in at the ICO price for such highly capitalized alt-coins as IOTA, Ethereum and NEO and stayed the course, the returns were heart-stopping—271,333%, 150,343% and 124,161% respectively, as of writing.

But regulatory oversight of the asset class remains fluid globally and investor protections can be spotty depending on where the offering is based. As well as outright scamming and purely fraudulent offerings, as the environment matures, investors are also encountering an array of unexpected fallout—everything from conflict between cryptocurrency founders and the foundations set up for a token's benefit, to developers breaking loose in order to launch their own version of a digital currency on which they previously worked.

Are there red flags an ICO investor can pinpoint, in order to steer clear of messy or even downright criminal offerings?

The best ICOs come very close to traditional venture investments says Andrea-Franco Stöhr, CEO of Crypto Finance Conference. The industry itself has made this possible he points out. Platforms such as Coinlist and ICODrops, exchanges that enable blockchain-powered projects to raise funds in the most compliant way possible—providing information, transparency and even ratings on an ICO itself—make it easier for investors to find relevant information, even as the SEC and other regulators slowly finalize their legal frameworks.

Well known VC firms are also smoothing the way for private investors to participate in initial coin offerings via managed, focused funds. Last week, high profile Silicon Valley venture firm Andreessen Horowitz launched a16z crypto, its own fund for investing in cryptocurrency companies and protocols. Though the $300 million fund will be investing in established, later-stage assets such as Bitcoin and Ethereum, they've also made it clear they plan to invest in crypto-focused companies and protocols at different stages of development and maturity, providing seed capital for pre-launch ventures as well. Stöhr says:

“In that way investors, in principle, do not need to worry about compliance and spend months on due diligence. In some sense those crypto funds are actually pretty close to classic venture funds. While such funds usually have more liquidity with tokens, some of the well-known companies state that they are planning to hold on to these tokens for years.”

KYC and AML

Two themes have become prominent among ICO investors and issuers: know your customer (KYC) and anti-money laundering (AML) audits. How is the crypto community addressing KYC and AML issues?

According to Chance Du, founder of Coefficient Ventures, the proper way to solve the KYC or AML issue is to set up and register an offshore entity. “This is mainly due to the fact that many ICO investment opportunities are not open for US and Chinese investors.”

Richard Ettl, CEO of Smart Containers Group, believes KYC and AML have become standard practice for the most up-to-date ICOs. Citing his own company as an example, Ettl notes:

“For Smart Containers Group, as a Swiss company, the minimum standards are extremely high in comparison with other jurisdictions. In the Smart Containers Group ICO we wanted to set the standard in compliance, and applied it to every investor. This definitely made hosting an ICO more complex and costly, as KYC/AML checks are an expensive undertaking. The decision in turn drove up the minimum investment amount to $500 USD. I think it would be helpful to have a simplified version of KYC/AML for amounts which are less than $1000 USD.”

But an offerer's efforts at scrutiny aren't necessarily sufficient. As with every other investment, caveat emptor applies. Shane Brett, co-founder and CEO of GECKO Governance, points out that before participating in an ICO, would-be participants should ensure they've considered every aspect of the project. This includes: knowledge of the project team; planned use of the ICO's proceeds; AML/KYC requirements; and the overall roadmap for the project itself. Cautions Brett:

“This nascent industry does not yet have a large body of brokers or investment advisors to consult as you would with traditional finance, so very detailed consideration should be given to an investment. This however, is a considerable body of work for an investor to undertake on their own.”

Overcoming Trust Issues

It's never easy to build trust around a project says Roberto Rabasco, co-founder, application and cloud technology expert at Orvium, but there are multiple ways to prove its validity, especially in the information era we live in. “Anyone can easily check project founders’ profiles, as well as their professional networks, publications, and areas of expertise," he says. "We've recently seen jurisdictions enforcing KYC or AML for exchanges, so we expect a massive growth in companies offering similar services.”

With Facebook's recent reversal of its crypto ad ban for pre-approved companies via KYC applications advertisers will be required to submit to the social media giant, digital currencies may have an additional way to push higher. Though ICO offerings will still be banned from Facebook, Rabasco believes project founders who play a key role in the project's community can and will have a significant part in reversing the ICO ban as their reliability and efficacy become known. As well, he expects the reversal along with its guidelines, will most likely be adapted by other big tech, social media businesses.

However, warns Gianluca Giancola, co-founder and head of UX and design at blockchain-powered loyalty ecosystem qiibee, new cryptocurrencies also tend to attract a lot of hype, often from investors who are typically ill-informed and looking to make a quick buck by pumping something they already own. He stresses that the focus needs to be on the fundamentals.

Aside from information previously discussed, that also means getting specifics on trading volume and liquidity, as well as whether it will be easy for investors to exit after they've opted in. Other significant questions to ask include which exchanges will trade the new cryptocurrency and whether those exchanges have had a history of data security breaches or hacker attacks.

Foundations Behind the Offering

Every organization has its politics and conflicts, something that's especially with many start-ups. Chance Du notes that when investing in cryptocurrency, it’s important to take a close look at the foundation behind the team. Investors should look at how many years the founders have worked together, she says. If the foundation or team is newly formed, there's a greater chance it will have a negative effect on the offering or stir up issues.

“We looked at an ICO investment recently, and the founding team split before the fundraising was complete. If the foundation of the ICO is unstable, the project itself will have big problems and it will definitely affect the performance of this investment.”

Elliot Rothfield, founder and director of WatermelonBlock explains that the current sentiment surrounding the crypto-market is one of skepticism, with many investors hesitant about participating. But, he says, this attitude can also be viewed from a positive perspective. Rothfield explains that investors need to be hyper-aware of the reality of fraudulent projects and scams within the space, but like most things in life, the more time spent researching and actually investing the more adept one becomes.

Of course, at the very core, the quality and depth of one's due diligence is the critical component of both success and experience. Felix Hötzinger, senior advisor at GAMB says standardized and well-proven processes such as KYC and AML are becoming the norm for crypto projects even as local and global regulatory organizations continue to try and define an appropriate standard for the crypto-sphere.

But first and foremost, interested investors are the initial and perhaps their own best line of defense.

"In any case, we suggest that each contributor should do their own due diligence, similar to investing in traditional asset classes. The regulatory framework will continue to define rules which will help to professionalize the crypto space over time.”