Tesla (NASDAQ:TSLA) exploded higher at the open after first-quarter earnings shocked Wall Street with a healthy sized (paper) profit. Plenty of other contributors are covering the earnings report so I don’t need to rehash the details here. More interesting to me is yesterday's subsequent price action. After smashing through $800 resistance at the open, that was as good as it got for the stock. The rest of the day was spent giving back all of those gains and eventually skidding into the red.

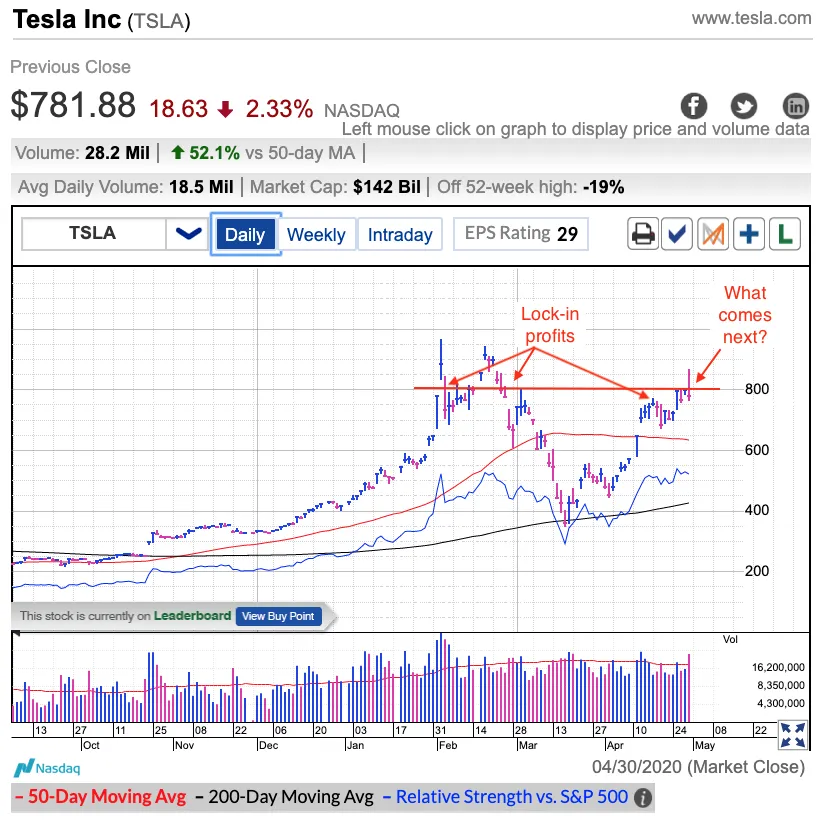

Since early February, I’ve been saying $800 was a key level for the stock. Back then it was a critical stop-loss for protecting profits following Dec-Jan-Feb’s spectacular surge higher. Then in early March, it became a ceiling for the subsequent rebound and most recently, it was a smart level to be taking swing-trading profits near following the $600 breakout.

After taking profits near $800, the plan was to get back in by either buying the dip to $600 support or a breakout above $800 resistance. With the stock trading in the middle of the $600 to $800 trading range, it could have gone either way. This time it happened to push back to $800 and breaking above $800 Wednesday near the close created a buying opportunity.

Everything looked great yesterday morning following the stellar earnings and the market’s initial enthusiasm. But rather than embrace the higher prices, traders started locking-in profits and shorting almost immediately. That’s never a good sign. We want to see follow-on buying, not overpowering waves of profit-taking. That tells us more investors are concerned about these highs than they are excited to chase them.

I’m not ready to give up on the stock yet and a rally back above $800 is still buyable. But if prices cannot get back above $800, that tells us demand is a serious problem. If $800 turns into a ceiling, that is a great short entry with a profit target near $600 support.

As usual, no matter which way this goes, start small, get in early with a nearby stop, only add once the trade starts working, and if we get stopped out, consider switching directions and going the other direction. Being wrong is okay as long as we admit defeat early and start preparing for the next trade as soon as we jump out.