Economic Commentary

The year 2016 was dominated by an environment of multi-year lows in oil prices and global bond yields as well as political surprises. Much of this is set to change in 2017, where we see five key themes emerging. First, we expect a shift in policy focus from monetary to fiscal in AEs. Second, we expect expansionary fiscal policy in the US to push the Fed to tighten monetary policy at a faster pace, raising US yields.Third, higher US interest rates are expected to increase the risk of capital flight from EMs. Fourth, we expect a recovery in global oil prices as the market rebalances with OPEC production cuts and strong demand growth. And fifth, we expect heightened political risk with the rise of populism and important elections in Europe.These themes predominantly offer positive growth dynamics for advanced economies (AEs), but could act as a drag on growth for emerging markets (EMs).

First, the anticipated fiscal stimulus in AEs in 2017. In the US, Trump has promised tax cuts and infrastructure and defence spending. Elsewhere, monetary policy has reached its limits with interest rates as low as they can go and quantitative easing losing efficacy. For instance, the ECB’s deposit rate is at -0.4% and it is running out of assets to buy due to restrictions on its quantitative easing programme. Years of fiscal austerity and falling interest rates have helped create fiscal space and a number of major economies are now planning a stimulus for 2017. In Europe, draft budgets submitted to the EU point to stimulus and spending tends to rise in election years. Both Japan and the UK have announced increased infrastructure spending. The fiscal stimulus in advanced economies should help raise growth to 1.7% in 2017 from 1.6% in 2016.

In the US, fiscal stimulus is expected to raise growth and inflation, implying faster rate hikes by the Fed. This leads to our second theme of rising US yields. The US Treasury 10-Year yield has risen around 50bps since Trump’s election on the expectation of a large fiscal stimulus. If Trump’s tax cuts and infrastructure spending are implemented, US interest rates are likely to continue to rise.

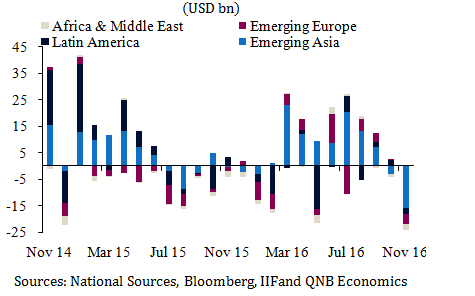

Net portfolio flows of EM equity and debt (USD bn)

Sources: National Sources, Bloomberg, IIFand QNB Economics

Third, higher US interest rates are likely to encourage capital flight from EMs. Following the election of Trump, EMs experienced their worst month of capital outflows in 2016 with an estimated net outflow of USD 24bn in portfolio flows in November. Additionally, Trump touted a number of protectionist policies on the campaign trail, which, if implemented, would also be negative for EMs. As a result, 2017 could be a tough year for EMs with growth expected to slow to 4.0% from 4.2% in 2016.

The fourth theme is the global recovery in oil prices. We expect oil prices to average in the range of USD55-60/b next year, depending on the extent to which the recent OPEC agreement is implemented. The agreement committed to 1.2m b/d of cuts within OPEC and 0.6m b/d from non-OPEC. Overall, EMs should benefit from the recovery in oil prices, while higher oil prices should act as a drag on growth in the US and euro area, which are net oil importers. However, higher oil prices are unlikely to offset the more powerful growth drivers mentioned above.

Finally,politics in 2017 will be in the spotlight. Populism was on the rise in 2016 with nationalist, anti-immigration and anti-globalisation sentiment voiced loudly through Brexit, the election of Trump and the recent Italian ‘no’ vote on constitutional change.In 2017, ongoing Brexit negotiations and elections in France, Germany, Netherlands and potentially Italy all pose downside risks. Election victories by populist candidates could increase isolationism and protectionism, calling into doubt the very existence of the EU and the Eurozone. This would increase uncertainty, financial market volatility and could negatively impact growth.

Since the financial crisis, global growth has trended downward along with falling inflation and lower interest rates. However, the global economy is set to see a significant shift in 2017 as it moves from ever easier monetary policy to fiscal stimulus and as the oil price recovery becomes entrenched. This could lead to an about turn in the global economy, starting in AEs with higher growth and inflation. As such, 2017 could be the year when the new normal turns old.