The largest risk event of the week is looming as the US Non-Farm Payrolls (NFP’s) threaten to make their presence felt. However, the question remains whether the key labour market metric will be able to dig the US dollar out of its doldrums or if it will be just another April fool’s day surprise.

The NFP results have typically brought a significant amount of volatility to the capital markets, especially when you consider their place in the Fed’s policy setting process (or non-process). However, this time around the results might do little to buoy the dollar given that the Fed has already walked away much of the expectations around rate hikes. Given that Janet Yellen has signalled their intention to not hike rates in April, it leaves little reason to ponder the labour market figures.

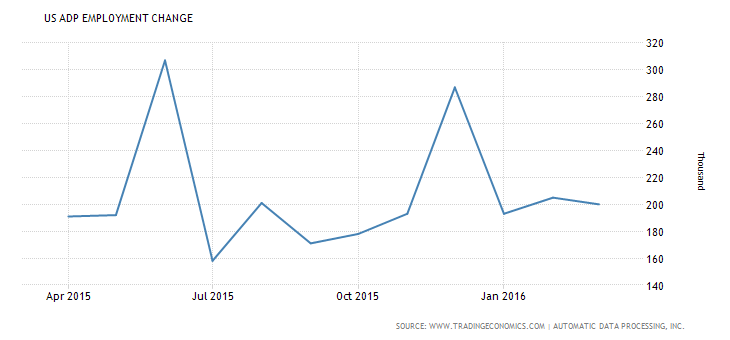

Subsequently, regardless of the fact that there is plenty of advance evidence (ADP Result) pointing to a strong NFP number, it is likely to have little upside impact to the dollar. However, if the result is relatively weak, you can expect market sentiment to turn relatively nasty and send the greenback reeling. However, the question remains as to the likelihood of a softer than expected non-farm payroll outcome.

A recent review of the key US Labour Market indicators casts some significant doubt on the growing “strength” within the job market. In fact, even without accounting for some of the significant problems with how job creations are recorded, the ADP NFP results have been slipping for some time. The overall trend since December of last year has been one of falling job growth with the latest result falling from 205k to 200k. Subsequently, even without all of the reporting anomalies that typically inflate the figure, the metric has still been trending lower.

In addition, the US Unemployment Claims data has been slowly creeping higher suggesting that future NFP results could be sharply weaker. Early March was largely the turning point for initial job losses as the indicator sharply increased from 253k to 276k throughout the month. Although still relatively low on an historical basis, the recent increases are certainly cause for concern to both the Fed and the US public. Given the natural time lag to this data, it is highly likely that there could be further increases waiting in the wings throughout April.

Subsequently, despite an incredibly low US Unemployment Rate of 4.9%, there is plenty of labour market data doing the rounds which suggest that there could be some credence to the case for a softer NFP result. In addition, the US Federal Reserve may be expecting just this scenario given the fact that they have “all of a sudden” turned relatively dovish on the prospect of rate hikes. This would tend to imply that the risk of a global downturn is currently overshadowing any forecast strength within either the labour market or Core PCE Inflation.

Ultimately, given the lack of importance that the current round of NFP results poses for the Fed’s monetary policy, don’t expect much of an upside move by the dollar upon release. In fact, I suspect that even a small whiff of weakness within the data could see the USD tumbling as the sentiment moves to turn toxic.