Keryx Biopharmaceuticals, Inc. (NASDAQ:KERX) is expected to report second-quarter 2017 results on Jul 27.

Last quarter, the company missed expectations by 16.7%. In fact, Keryx’s performance over the last four quarters has been disappointing. The company reported a wider-than-expected loss in all the trailing four quarters, with an average negative surprise of 39.32%.

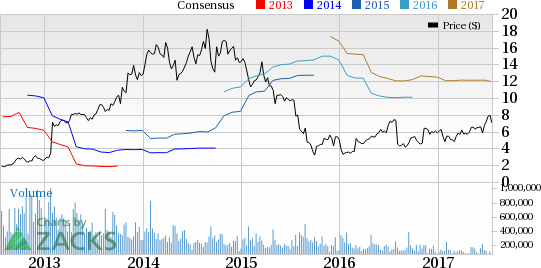

Keryx’s share price has increased 20.6% year to date, outperforming the industry’s 11.2% rally.

Let’s see how things are shaping up for the company this quarter.

Factors Influencing This Quarter

Apart from license fees, Keryx’s top line comprise revenues generated by its only marketed product Auryxia (ferric citrate). Auryxia is approved as tablets to control serum phosphorus levels in patients with chronic kidney disease (CKD) on dialysis.

Notably, with Auryxia being the only approved product in Keryx’s portfolio, the company is entirely dependent on it for growth. Launched in the U.S. in late Dec 2014, Auryxia is still in its early stages of commercialization. However, Keryx is working on its commercial efforts for Auryxia. In fact, the company is currently working on gaining formulary status for the drug. In Mar 2017, the nation’s largest Medicare Part D plan sponsor added Auryxia to its Medicare Part D plan formularies. With these formulary additions, 95% of the patients taking a phosphate binder across Medicare Part D and commercial plans now have unrestricted access to the drug.

Additionally, it is working on contracting the remaining insurance providers to expand patient access to Auryxia. This should enable more contact with the prescribers, both current physicians and those who have not prescribed Auryxia, yet. Meanwhile, Keryx expanded its field-based team to 95 sales representatives, which led to an increase in the number of dialysis patients on Auryxia.

Moreover, Keryx is working on expanding ferric citrate's (the compound name for Auryxia in additional indications) label to include the treatment of iron-deficiency anemia (IDA) in patients with stage III–V non-dialysis dependent chronic kidney disease indication (NDD CKD).

In Mar 2017, the FDA accepted the company’s supplemental New Drug Application (sNDA) for Auryxia for review (PDUFA date: Nov 6, 2017). If approved for this indication, Auryxia might be the first FDA-approved oral medicine to treat IDA in this patient population. We believe a potential approval will significantly boost sales of Auryxia, going forward.

What Our Model Indicates

Our proven model does not conclusively show an earnings beat for Keryx this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. However, that is not the case here as you will see below.

Zacks ESP: Keryx’s has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 17 cents.You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Keryx’s has a Zacks Rank #3, which increases the predictive power of ESP. However, 0.00% ESP makes surprise prediction difficult for the quarter.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement.

Stocks to Consider

Here are some health care stocks that you may want to consider, as our model shows that it has the right combination of elements to post an earnings beat this quarter.

Agenus Inc. (NASDAQ:AGEN) has an Earnings ESP of +5.56% and a Zacks Rank #2. The company is expected to release results on Jul 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gilead Sciences, Inc. (NASDAQ:GILD) has an Earnings ESP of +3.32% and a Zacks Rank #3. The company is scheduled to release results on Jul 26.

Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT) has an Earnings ESP of +9.39% and a Zacks Rank #3. The company is expected to release results on Aug 3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think. See This Ticker Free >>

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Agenus Inc. (AGEN): Free Stock Analysis Report

Keryx Biopharmaceuticals, Inc. (KERX): Free Stock Analysis Report

Intercept Pharmaceuticals, Inc. (ICPT): Free Stock Analysis Report

Original post