On Thursday afternoon, President Trump announced that he was nominating Federal Reserve Governor Jerome Powell to serve as the next central bank chairman.

You could almost hear the sigh of relief from financial professionals and economists around the world. Powell is seen as a status quo candidate who will continue the policies of his most recent predecessors, Ben Bernanke and Janet Yellen.

What does that mean for your portfolio? It’s hard to say. Long-term economic predictions like this are notoriously difficult (especially when the Fed is involved). But in the paragraphs below, we’ll do our best to tell you what to expect.

Staying the Course on Interest Rates

Like Yellen before him, Powell is considered fairly “dovish” in his views on monetary policy. Doves are central bank officials who are mainly focused on maximizing employment. They’re the opposite of hawks, who are more concerned with keeping inflation down.

In today’s economy, doves favor keeping interest rates low in order to stimulate spending and investment. Hawks want to raise rates in order to keep the money supply and price levels under control.

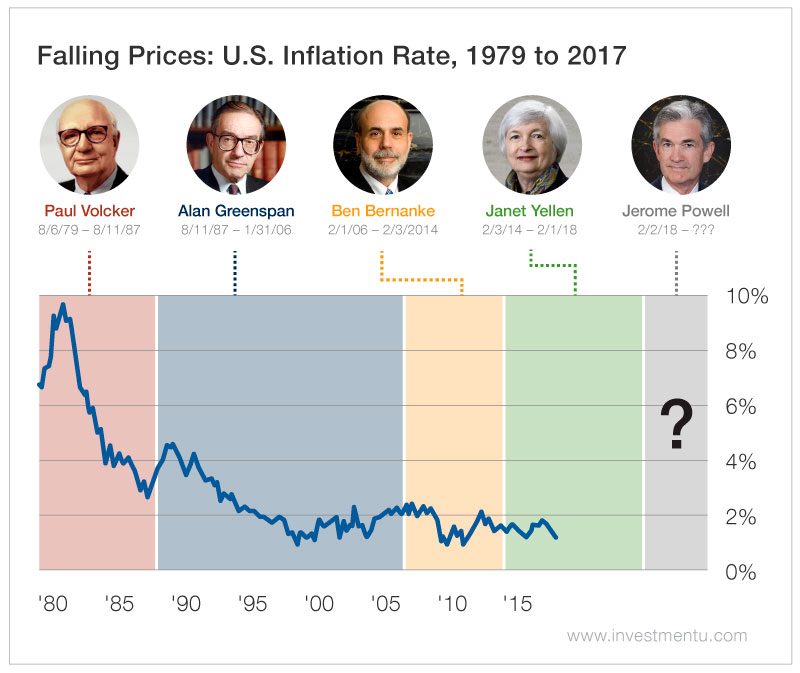

And as you can see from this week’s chart, doves have had the upper hand for the last decade or so. Inflation - the mortal enemy of hawks everywhere - has been almost nonexistent since the financial crisis. As a result, Fed chairs since then have generally favored low rates. Jerome Powell is no exception.

So Powell’s nomination isn’t the best news for savers. If you keep most of your money in savings accounts or Treasury bonds, you’ll probably have to put up with those super-low yields for a few more years.

For equity investors, on the other hand, Powell’s nomination means “crisis averted.” If media reports are to be believed, the runner-up for the job was Stanford University’s John Taylor, a hawkish economist who thinks interest rates should be substantially higher than they are now.

Taylor’s rate hikes would have been nice for savers... but they would have also risked sending the stock market (and the broader economy) into a downturn. With Powell in charge of the Fed, we don’t have to worry as much about that.

The Great Unwinding

Given Powell’s alignment with Yellen, we have a pretty clear picture of what he’ll do with interest rates. But how will he go about unwinding the Fed’s $4.5 trillion balance sheet? That’s a big question mark.

As you may recall, the Fed responded to the Great Recession with a controversial policy known as quantitative easing. It bought gobs of government debt securities and mortgage-backed securities, raising their prices and lowering their yields. Some economists say it worked; some say it didn’t.

Now the financial crisis is years behind us, and the central bank has to figure out what to do with this gigantic pile of debt securities. Will they let it roll slowly off the balance sheet? Or will they sell it quickly and risk upending debt markets?

We can’t look to Yellen for answers here. As she said at a recent dinner with Oxford Club Editorial Director Matthew Benjamin, the Fed “does not have any experience in calibrating the pace and composition of asset redemptions and sales.”

That’s a very Yellen way of saying, “I dunno.”

Jerome Powell is coming into a complicated job with a lot of moving parts. His responsibilities will include setting interest rate policy that’s fair to savers and investors, unwinding a 13-figure balance sheet, providing sensible guidance on financial regulation, and not destroying the economy in the process.