“Winners make a habit of manufacturing their own positive expectations in advance of the event.” -- Brian Tracy

Much of my posts, here on Investing.com of late, have focused on Silver (SLV), Spain (EWP) and the reflation trade as a reason to believe in the Summer Surprise of higher highs.

The Message Of Price

As I noted on CNBC last week, the cyclical-growth trade appears to be strengthening as dividend heavy/low beta sectors (“dividendsanity”) break in favor of risk-taking. I think what many are missing about this broader move higher in risk assets is the message of price based on what has performed particularly well in the last month.

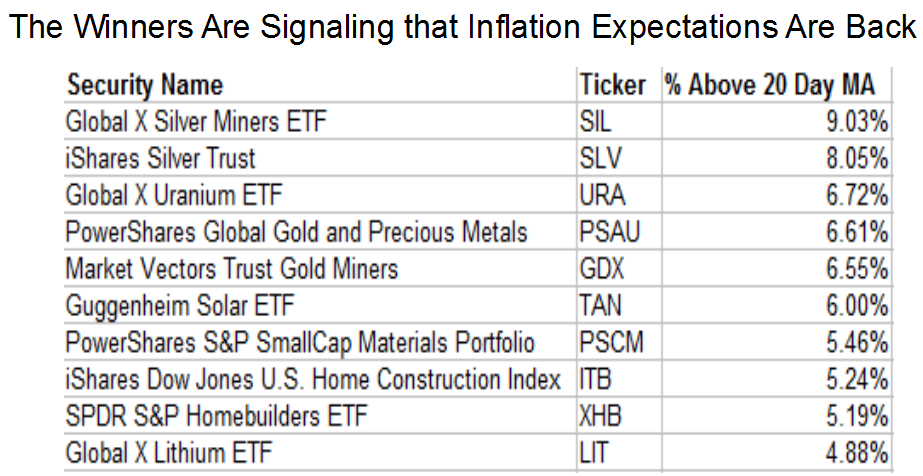

That said, every now and then I run a screen on my list of over 1000 ETFs/ETNs for those areas of the investable landscape that are furthest away from their respective 20-day (one trading month) moving averages. I do this to identify if a certain theme is pulsing through money allocation toward risk.

Listen To The Metals

I think the list is actually quite telling about market movement in the past rolling month. As chatter has grown over Fed policy action and bond yield targeting by the European Central Bank, the winners uniformly have been in the precious metals space, with Gold Miners (GDX), Silver Miners (SIL) and Silver itself (SLV) staging very strong gains. Homebuilders (XHB) also continue to defy the skeptics by continuing their vertical leadership since the October 3 low of last year as housing stabilizes in the U.S.

Talking Inflation

What's the message here? Inflation expectations are rising given what appears to likely be a moment of global shock and awe in terms of Fed, ECB and potential PBOC stimulus to come. The momentum appears strong and early in the metals, energy and homebuilders trade, which means inflation expectations may have quite a bit further to run.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What The Winners Are Saying

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.