One of the biggest positive stories in the investing world so far in 2014 has been the surge in the natural gas market. Products in this category have easily crushed the market as incredibly cold weather has gripped much of the nation, sending heating demand (and thus natural gas usage) through the roof.

In fact, the United States Natural Gas ETF (UNG) has been a star performer over the trailing one month time frame, adding close to 25% in the period. This is in sharp contrast to what the fund usually does, as long term performance is pretty horrendous for UNG, largely thanks to an unfavorable futures curve which results in a poor roll yield for natural gas ETF investors.

But with the Polar Vortex looming over the Central United States, and massive storms hitting the East Coast on a pretty regular basis, futures curve issues didn’t come into play at all. Instead, record drawdowns in supplies shocked the market and helped natural gas futures to show some strength so far in 2014, and be one of the few bright spots in the market.

Equity Play

Given this surge in the futures market, investors might think that equity plays that focus on natural gas were performing well too. However, this hasn’t been the case, at least for the top natural gas equity ETF, the First Trust ISE Revere Natural Gas Index Fund (FCG).

This product tracks the ISE-REVERE Natural Gas Index, focusing on companies that derive a substantial portion of their revenues from the exploration and production of natural gas. The benchmark uses an equal-weight method in order to assign weights, thus ensuring that no single company dominates the index.

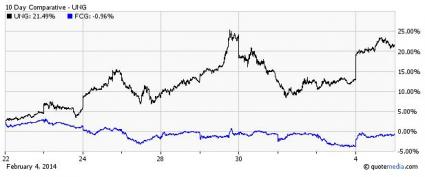

With its spread out profile and the surge in natural gas, a big move higher might have been expected in this product. However, this hasn’t really happened as FCG has added just under 2% in the past month, failing to capitalize off of the huge run in the natural gas space. In fact, over the past ten days, FCG is actually posting a loss, while UNG has seen a gain of nearly 21.5% in the same time frame.

What Does This Mean?

Though FCG may start to rise, and especially so if the price for its components’ main product holds firm, it is clear that some commodities have a better relationship with their equity counterparts than others. Funds in the silver and gold space have a pretty robust correlation with their underlying metals, though the same relationship doesn’t appear to hold true in the natural gas market.

So just because natural gas futures are surging, it doesn’t mean that the equity linked to the commodity will see robust gains as well. Instead, a solid but relatively uninspiring performance is to be expected, suggesting that investors who are looking for big moves in natural gas should look to the futures world—and away from equities—at this time, as the correlation during this huge move higher hasn't been too tight (or favorable) for investors in FCG.