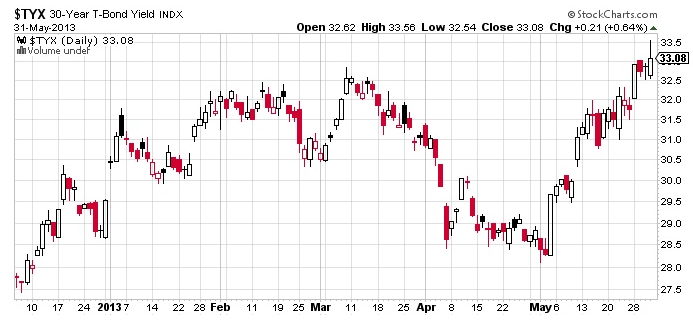

In May, the bond market suffered the biggest monthly sell-off since 2004. (Source: Bloomberg, June 3, 2013.) To gauge the extent of the selling, take a look at the chart below, which shows the yield on a 30-year U.S. Treasury.

From the first trading day of May to the last trading day of the month, the yield on a 30-year U.S. bond increased more than 17%—soaring from 2.81% to above 3.3%. This move is significant for the bond market, because as the yields on bonds rise, their prices fall.

What does this mean? Traditionally, rising bond yields indicate inflation ahead, something I have been warning about. But if I had to bet, I would say investors have tired of the low yields offered by government bonds and are moving into higher-risk investments, such as the stock market.

What we already know is that as the yields on U.S. bonds declined, bond investors moved from the security of U.S. government bonds into higher-yielding bonds—those that are higher-risk and are often considered speculative by credit rating agencies.

We can see the move to higher-risk bonds in the number of new non-government bond issues. In the first four months of this year, $115.1 billion worth of high-yield U.S. corporate bonds were issued. (Source: Securities Industry and Financial Markets Association, May 14, 2013.) In 2012, $329.2 billion worth of high-yield debt was issued in the bond market, and in 2011, this number was $224.1 billion. That adds up to $670 billion in corporate bonds in 28 months!

Taking all this into consideration, as the yield on 30-year U.S. bonds moves higher, the yield on corporate bonds in the bond market will rise further and bond prices will go lower—which means bond investors will take a loss if they sell early. And of course they will sell early, as few investors actually hold long-term bonds until maturity.

According to Lipper Data, high-yield bond funds in the U.S. witnessed withdrawals of $875 million in the week ended May 31. This was the biggest outflow from these types of funds since February. (Source: Bloomberg, May 31, 2013.)

Bond investors need to practice extreme caution, because the dynamics of the bond market have changed. The most basic indicator of the bond market, the 30-year U.S. Treasury, is showing weakness ahead. If this continues it will result in an even steeper sell-off throughout the bond market.

When the yields in the bond market fall, bond investors face severe losses. I wouldn’t rule out a mass exodus from the bond market.

Original Post

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What The Rising Yield On 30-Year Treasuries Is Telling Us

Published 06/06/2013, 05:03 AM

What The Rising Yield On 30-Year Treasuries Is Telling Us

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.