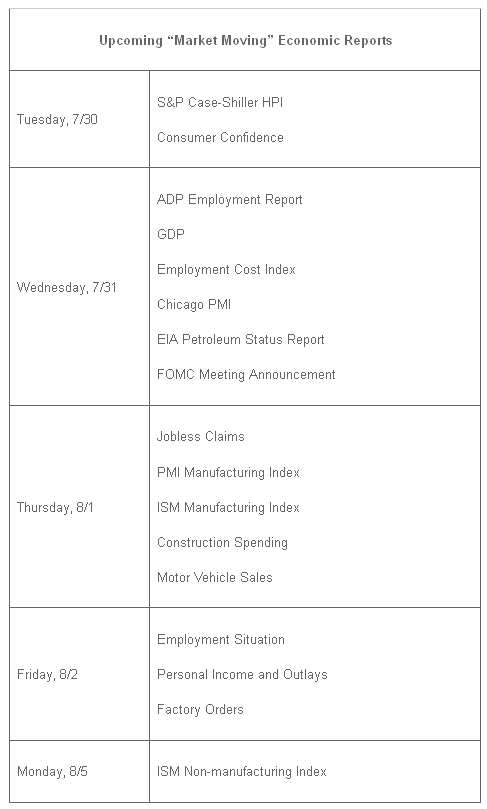

We finally had another down week, albeit by the slimmest of margins. This next week promises to be the most important week of the month and, in all likelihood, next month as well. We get the ADP employment report, the FOMC meeting announcement, the first look at Q2 GDP, the Chicago PMI, the consumer confidence report, and more (see schedule below). Undoubtedly, today’s weakness was based on investor apprehension about this week’s news and continued corporate reports.

Last week’s economic reports were mixed, and the style/caps were simply “mixed up.” Our style/cap scorecard was turned on its head last week with year-long loser Large-Cap Growth up +0.26% to become the week’s leader and the last year leader (and still leader for the year) Small-Cap Value, bringing up the rear for the week at -0.15%.

Say what?

Not sure we can explain that one. Frankly, the scores were close enough anybody could have had first place with a great Friday.

Corporate reports were mixed as well. A majority of companies continue to produce another quarter of earnings beats, but more companies this quarter are missing on the top line. So the bevy of economic reports this week, along with the FOMC report and early GDP numbers, could determine which direction this market will go for at least the rest of the summer.

Our feeling is that if there are no negative shockers in the week, the continued flow of funds from fixed income to equities will drive the market higher by summer end. Nevertheless, continued global economic concerns, albeit abating somewhat in Europe, signal CAUTION.

So this week we found a few Goldilocks stocks that weren’t too big or too small, that weren’t too expensive or too cheap (signaling something wrong), and that were in different sectors. In the current market environment, these stocks look “just right.” They haven’t jumped right out at us in the past few months, but nonetheless they’ve avoided negative earnings surprises and seem likely to continue their well-priced growth. Take a look.

4 Stock Ideas for this Market

Here are our stock picks for this market—two large-caps and two mid-caps, just in case last week’s small-cap dive was the beginning of a new trend (which we doubt).

Ameriprise Financial, Inc. (AMP) -- Financial Sector - Large-cap

AMP is a diversified financial services holding company providing, through its subsidiaries, a range of financial products and services in the United States and internationally. Double-digit growth expected short-term, with an expected annual growth rate of 19.30% over the next 5 years. AMP has had positive earnings surprises for the past 4 quarters, and 11 of 13 analysts have raised current year estimates within past 30 days. Al for a forward P/E of 11.48. AMP has a dividend yield of 2.40%. Website: www.ameriprise.com Price (close) on 7-29-13: $87.61

iGATE Corporation (IGTE) -- Technology Sector - Mid-cap

iGATE delivers a range of IT services through globally integrated onsite and offshore delivery locations, primarily in India. The company has double-digit earnings growth expectations for this year and next, with an expected annual growth rate of 16.67% over the next 5 years. It has had positive earnings surprises for past 4 quarters, ranging from 20% to 29%, and 8 of 9 analysts have raised estimates for the current year. iGATE's forward P/E is just 11.44 for all this projected growth. Website: www.igate.com Price (close) on 7-29-13: $22.75

Lennox International Inc. (LII) -- Industrials Sector - Mid-cap

Lennox designs, manufactures, and markets climate control products for the heating, ventilation, air conditioning, and refrigeration markets. LII's forward P/E is 16.36, which is reasonable for the projected earnings growth of 35.20% for this year, 20.30% next year, and 20.30% per year for next 5 years. All 11 analysts have raised their estimates for this year and next year. LII pays a 1.30 % dividend. Website: www.lennoxinternational.com Price (close) on 7-29-13: $71.88

Rock-Tenn Company (RKT) -- Basic Materials Sector -- Large-cap

Rock-Tenn manufactures and sells corrugated and consumer packaging products in the United States, Canada, Mexico, Chile, Argentina, Puerto Rico, and China. The company has had positive earnings surprises in 4 of last 4 quarters, with a 30% surprise in the most recent quarter, and 13 of 16 analysts have raised estimates for the current year. Projected earnings growth rates are high double-digits for this quarter (78.40%) and next (63.70%), with expected growth of 55.10% for this year, 35.40% for next year. RCT has a forward P/E of 11.93, and it pays a dividend of 1.10%. Website: www.rocktenn.com Price (close) on 7-29-13: $112.36 .

Full disclosure: The author does not hold positions in any of the stocks mentioned in this article.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What The Market Wants: 4 Goldilocks Stocks Worth Looking At

Published 07/30/2013, 02:52 AM

Updated 07/09/2023, 06:31 AM

What The Market Wants: 4 Goldilocks Stocks Worth Looking At

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.