One of the main drivers of gold prices recently has been the plunge in long-term interest rates. Gold is very negatively correlated to the change in real yields: when they fall it is bullish for the gold price and when they rise, not so much. (Please note I’m not referring to nominal interest rates here. Interest rates can rise and still be bullish for gold if they do so at a pace that is slower than the rise in inflation, thus yields after inflation still fall).

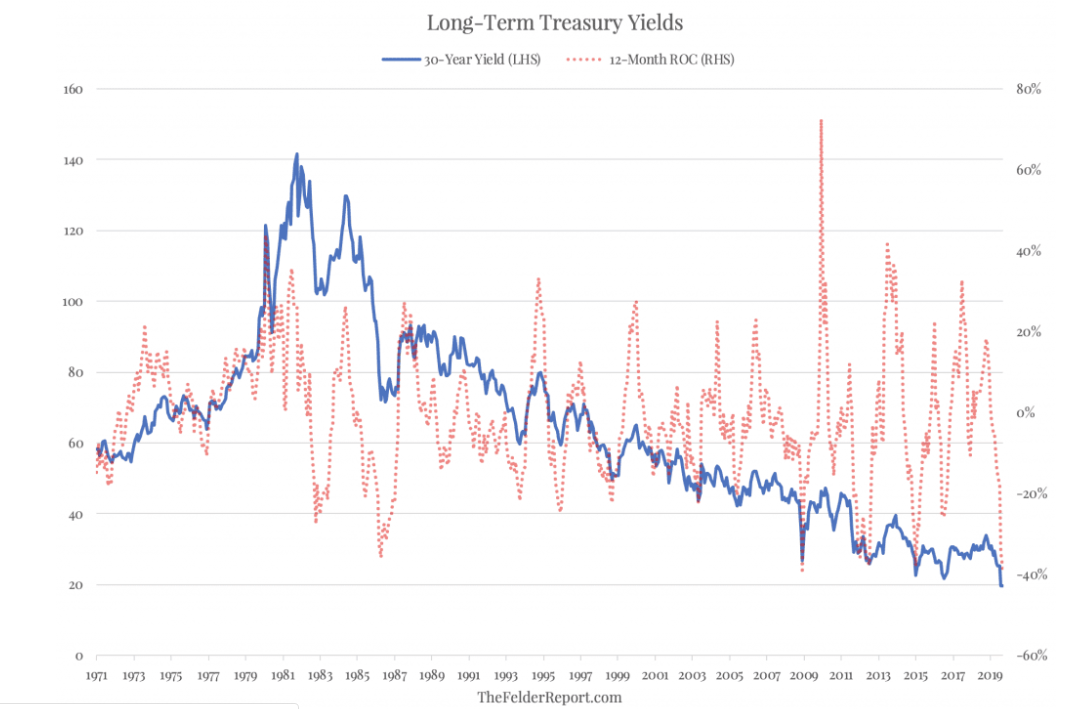

Nominal long-term interest rates recently fell at their fastest annual rate in at least 50 years, so it might be optimistic to think they will continue to fall much further. In fact, a reversal higher is very common after such episodes which would likely mean a correction for gold prices. For this reason, gold will probably need a pickup in inflation to really continue to power higher and, with interest rates now sitting at record lows, bonds are not likely to deliver decent real returns going forward on almost any time frame.