In the first half of the U.S. stock market bull (i.e., 2009-2011), 10%-19% corrections occurred annually. That has not been the case in the second half of the bull market. Instead, the frequency as well as the duration of setbacks lessened. There were several 7% sell-offs in 2012, a couple of 5% pullbacks in 2013 and a number of shake-ups here in 2014.

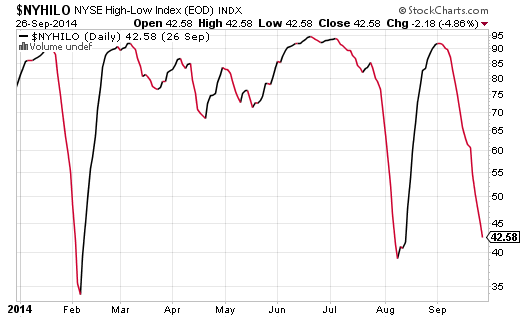

At the present moment, the NYSE High-Low Index suggests that our collective assets may be banging on a bearish wall. If recent patterns hold, however, the warning signal will promptly fade. Both the January-February decline as well as the July-August dip reversed direction quickly. If the prospect of losing money in U.S. equities is to shift from urban legend to harsh reality, the NYSE High-Low Index would need to move down into the “30s” and reside there for a month or more.

It rarely makes sense to favor “all-in” and/or “all-out” bets on market direction. On the other hand, reducing one’s overall allocation to certain asset classes is sensible when enough yellow flags wave tempestuously. Whether one employed unemotional stop-limit orders and/or trendlines in March-April – whether one employed those tools in July-August – reducing or eliminating small-cap U.S. stock exposure has been practical. Not only are the valuations absurd, but the dwindling reward no longer justifies the risk of participation.

It is not too late to cut back on funds like iShares Russell 2000 (ARCA:IWM). When the 50-day moving average for IWM crossed below its 200-day moving average in 2011 – an event that is affectionately referred to as “a death cross” – the exchange-traded small-cap proxy plummeted another 20%-plus. (Note: The cross for this ETF has not yet occurred, though it has occurred for the Russell 2000 Index.)

Small caps are not the only ETF canaries in the mines. Commodities via Greenhaven Continuous Commodity (NYSE:GCC), emerging markets via iShares MSCI Emerging Markets (ARCA:EEM) and higher-yielding bonds via SPDR S&P High Yield Bond (ARCA:JNK) are each below respective long-term moving averages. Weakness in these areas – coupled with ongoing strength in longer-term U.S. Treasuries – indicate that large-cap U.S. stock ETFs may follow. While the largest companies trading on the U.S. exchanges may cough up earnings and revenue stories that beat expectations, they’re still not capable of carrying the entire weight of a global economy on their shoulders.

The combined economic output of all countries, or gross world product (GWP), is getting weaker by the day. Many in the media tell us that we should invest in the corporations in nations where the economies are terrible, since those regions are bound to get more central bank stimulus. Is that all European and Japanese stocks require? Probably not. The same folks are telling us that we should invest in the U.S. because the U.S. economy is strong enough to withstand the end of quantitative easing and eventual rate hikes in mid-2015. Have U.S. stocks performed as well as they have because the U.S. economy is accelerating and no longer requires an ultra-accommodating Federal Reserve? Doubtful.

At the last meeting for the Group of 20, which includes the European Union, China, Japan, the U.S. and the U.K., finance ministers expressed concern over market complacency. The G-20 collectively said, “We are mindful of the potential for a build-up of excessive risk in financial markets, particularly in an environment of low interest rates and low asset price volatility.” How often do finance ministers from governments around the globe issue statements about the potential for loss in market-based securities? Comments from finance ministers that hint at irrational exuberance are not particularly common.

From my vantage point, even moderately aggressive and moderate risk ETF enthusiasts should rethink any hold-n-hope premises. Investment grade bonds via munis like Market Vectors Long Muni (NYSE:MLN) as well as Vanguard Long-Term Bond (ARCA:BLV) may not provide an extraordinary level of income. Yet the demand for safety as well as the demand for yields that are higher than government bonds elsewhere make these funds worthy. Similarly, funds like SPDR Nuveen Short-Term Muni (NYSE:SHM) and iShares Short Term Credit 1-3 Years (NYSE:CSJ) might require a larger allocation in your portfolio than usual. In essence, whether one uses a money market mutual fund or one of these cash-like proxies, cash-like vehicles are preferable than an over-sized allocation to small-caps or foreign developed stock.

Where does that leave the large-caps that have yet to tumble? I still own them. You can maintain an allocation to large U.S. companies through funds like iShares S&P 100 (NYSE:OEF) and Vanguard Mega-Cap 300 (NYSE:MGK). Just make certain that you already have a plan of action for when the levee breaks. The levee always breaks… eventually.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.