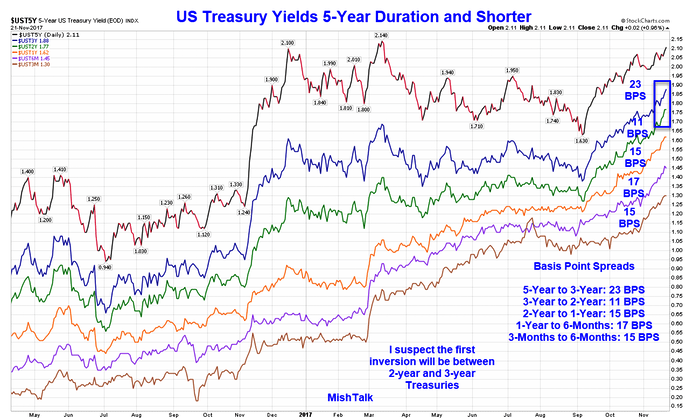

The yield curve has flattened considerably over the last year. Will it invert? Where? The following chart explains.

US Treasury Yields 5-Year Duration and Shorter

I created that chart Tuesday night.

After yesterday's plunge in Durable Goods Orders, the yield on 2-year Treasuries fell 4.1 basis points to 1.735%. The yield on 3-year Treasuries fell 4.6 basis points to 1.837%. The yield on the 1-year bond fell 1.8 basis points to 1.592%.

Current Spreads

10.2 basis points separate 2-year and 3-year Treasuries.

14.3 basis points separate 1-year and 2-year Treasuries.

It will not take a Fed rate hike for the curve to invert somewhere, but the more the Fed hikes the quicker the inversion.

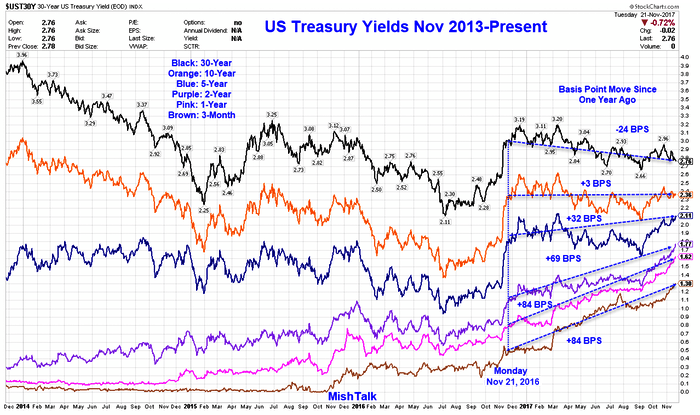

The above chart shows spreads highlighted in blue. The Following chart shows the strength of the move in basis points, not spreads, from a year ago.

Treasury Yields 2013- Present

We are not four hikes away from inversion as some think. Rather, were are likely one or two hikes away, or possibly even none.

One bad economic report might cause inversion this year.