Inflation: Headline Down, Core Up

The latest inflation data for the UK showed that the domestic economy remained in deflationary territory in October for a second consecutive time, the first time such an instance has occurred since the creation of the index in 1997. The initial read is obviously that this is a negative for the UK economy and further pushes out expectations of a BOE rate increase. However, the core measure of CPI, which the BOE actually favours as it removes the more volatile elements such as food and energy prices, actually rose last month to beat expectations by 0.1%. A second month of negative headline inflation is clearly a bad sign but the increase in core is an encouraging development for the BOE.

Energy Price Declines To Subside?

In their recent monetary policy review the BOE revised forecasts to reflect a lower outlook for inflation, expecting headline inflation to remain below 1% until spring next year and not likely to reach 2% until 2017. The caveat to this outlook however, will be how both global factors and energy prices unfold over this time period. If energy prices manage to sustain a quicker recovery then is expected, this will positively impact UK inflation. The sharp decline in oil prices, which cascaded from around $107 per barrel at the height of last year to around $42 at the lows, have for the most part been stemmed this year with current prices roughly unchanged and a yearly low of just circa $38 per barrel. The pause in these declines mean that from January, the negative effect of low energy prices in the yearly comparison will most be absent from that data which will translate into a higher inflation reading.

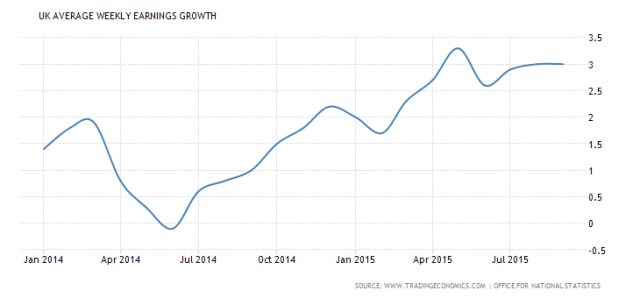

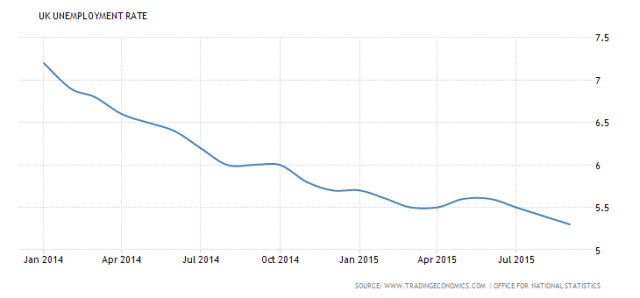

Unemployment Lower, Wage Growth Paused But Strong

The core driver behind the argument for an increase in UK rates has been the positive progression in UK labour market conditions. Wage growth has been steadily increasing. Some temporary disappointment was felt by GBP bulls last week as the latest average weekly earnings growth data showed that growth remained unchanged at 3% whilst earnings ex-bonus fell back to 2.5% from 2.8% last. However, these figures present only a minor pause in a very healthy trend of late and are also accompanied by a further decline in UK unemployment which now stands at 5.3%. The combination of current low inflation, fuller employment and increased wage growth create supportive conditions for domestic growth over the next year which should clearly reflect in upward price pressures. In comments made today, BOE’s Broadbent urged markets not to focus entirely on the BOE’s inflation forecasts but instead the broader factors affecting growth stating that UK tield curves are particularly flat and vulnerable to sharp sudden moves.

Fed Lift-Off To Support GBP

Tomorrow we have the minutes release from the October FOMC where the Fed signalled that a December lift-off is a strong possibility, a point which has been reiterated in recent comments by Fed chair Yellen. Traders will be looking to the minutes release for further endorsement of a potential December lift-off. A Hawkish minutes release and accompanying market view is likely to have positive spill-over effects for the UK as the strongest candidate for a rate-increase following the Fed. UK yields have been more responsive, in a positive sense, to increases in US yields compared to other G10 currencies, meaning that the rate spread between the UK and US will be less than that of the other G10 currencies heading into December which should allow GBP to perform better against the other G10 currencies. This proximity in yields has helped GBP to remain more resilient against US data surprises also, seen notably in GBP’s reaction to the recent US October NFP’s compared with that of EUR and JPY.

ECB Easing To Add Support Also

In addition to the likely positive effects of a Fed lift-off, GBP could also receive some support from further ECB easing in December. Should the ECB reduce the EuroZone deposit rate further, alongside additional QE, the market reaction should see capital inflow to the UK as foreign investors opt for UK capital markets. The second effect that further ECB QE could have is a potential mitigation of the risk-off sentiment we might see in response to a Fed lift-off. Low European yields make GBP an attractive currency in the G10 carry-trade environment which leaves it vulnerable to position unwinding in risk-off circumstances.

Trade Idea

With GBP likely to remain most resilient against an increase in USD and indeed, likely to outperform against the rest of G10, the higher-beta commodity currencies and indeed the euro, seem most exposed to USD induced downside.

Look to establish Long GBP against AUD, NZD and EUR

Currently stalled in a triangle formation within a bullish channel, the consolidation in GBP/AUD looks set to break to the upside. A close above the descending triangle resistance line targets a move back up into highs.

The bearish correction to the longer term bullish trend in GBP/NZD appears to be over with price now trading higher again. Retracements within the local bullish channel and VWAP support invite longs. Below there a retracement into key horizontal support at around 2.3040, against rising long term trend line support would be a good place for bullish entries.

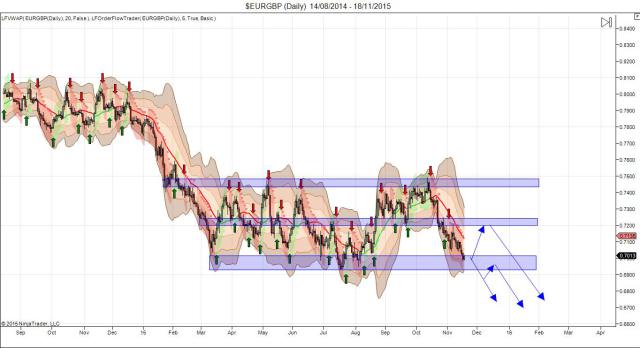

EUR/GBP has now traded down into the bottom end of its 2015 range. Prospect of ECB easing points to the upside correction in EUR/GBP having concluded and eyes now will be on a break lower. We may see an initial break of 2015 lows which invite breakout trades. However I will be monitoring a break and retest of the base in this instance. Alternatively if we see some rebound higher here I will look to set shorts into a retest of overhead resistance at around 72.