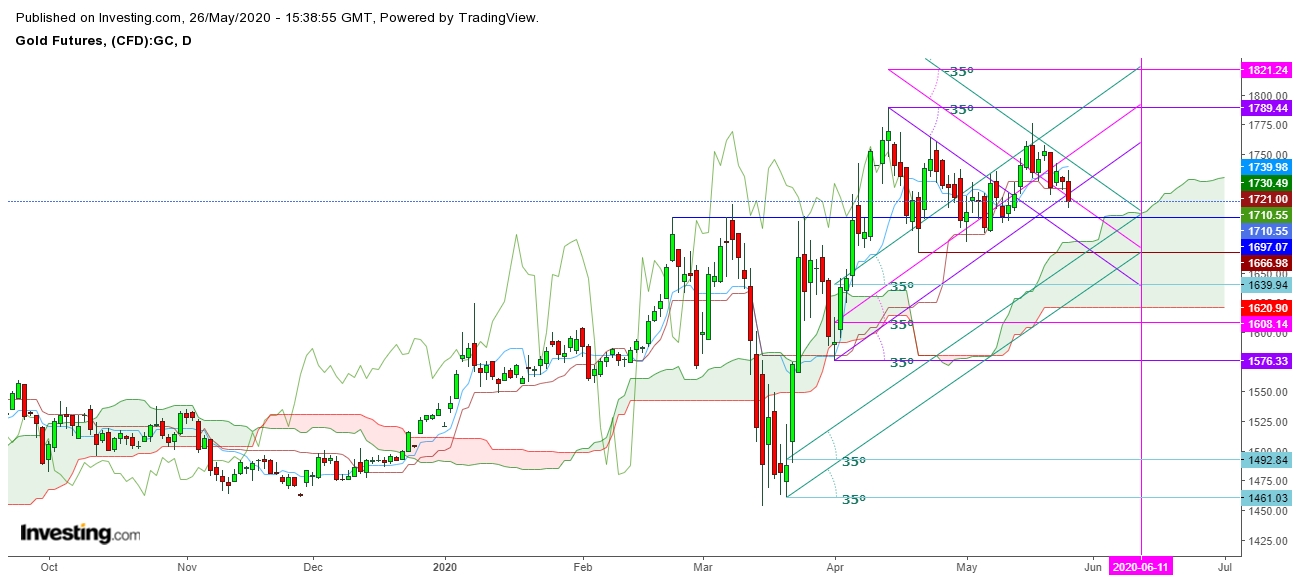

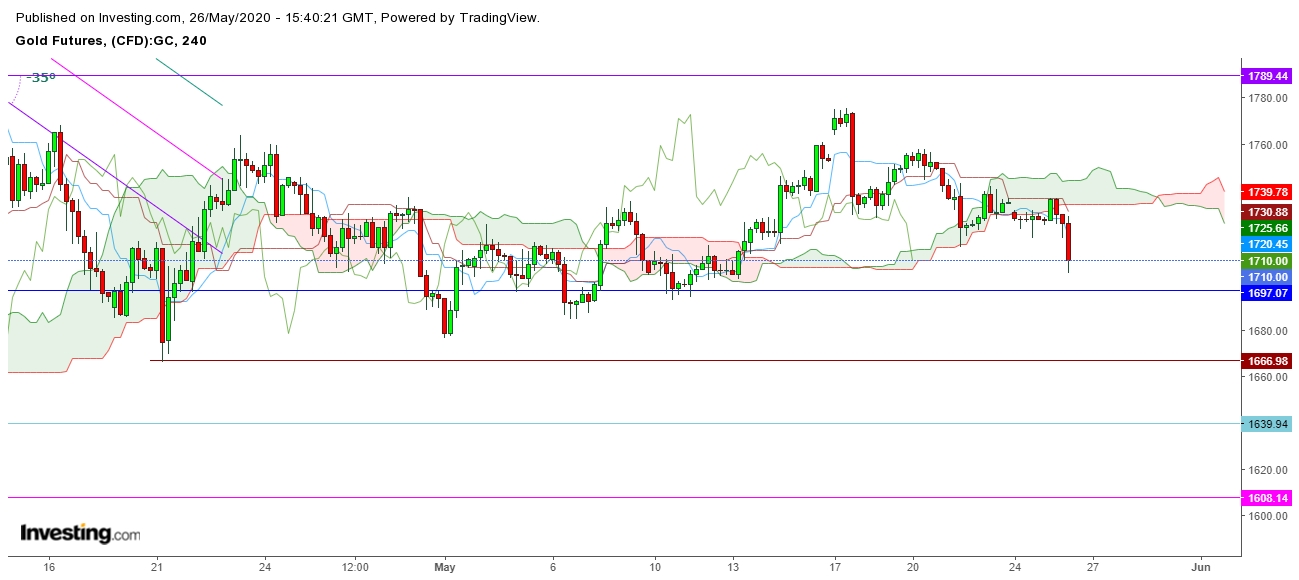

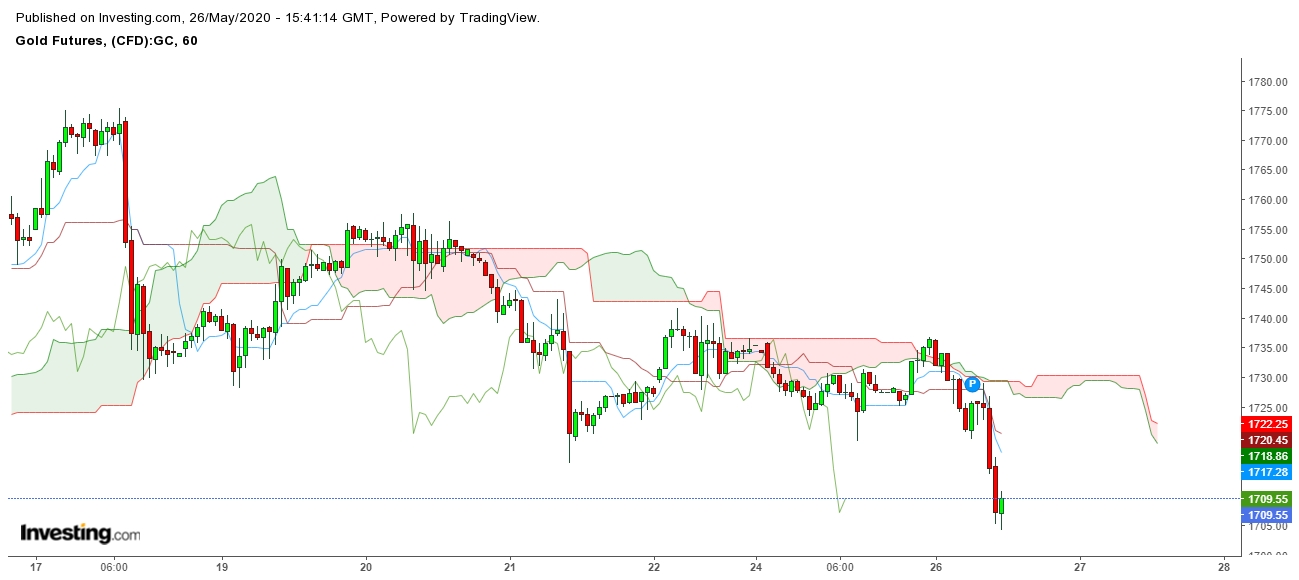

On analysis of the movements of Gold futures, in different time frames, I find that the current rally in U.S. equity markets is only a hope-based rally, which has spurred some bearish pressure in Gold futures. But, I find that the prevailing uncertainty in global equity markets due to straining relations between the U.S. and China could continue to disrupt the global supply chain. In the absence of a perfect biological cure of Covid-19, hopes will continue to generate such base-less rallies in equity markets.

I find that the currently prevailing indecisiveness in global equity markets may continue to provide good strength to gold bulls to sustain above the $1700. Gold futures may continue to consolidate in the range of $1697 - $1737; regaining more strength to move towards $1757 level.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.