On May 18, we issued an updated research report on Armstrong World Industries, Inc. (NYSE:AWI) . The company is set to benefit from acquisitions, improvement in average unit value (AUV), broad-based recovery in non-residential markets and innovation in product pipeline.

Armstrong World posted adjusted earnings of 55 cents per share in first-quarter 2017, which increased 10% year over year. Net sales increased 9.7% year over year to $315 million. Armstrong World now projects adjusted earnings per share to be in the range of $2.60–$2.70 per share for 2017. Adjusted EBITDA will be in the $350–$360 million range and sales in the $1.29–$1.32 billion range, both up from 2016 levels. This will be driven by low to mid-single digit volume growth in the Americas, with international volumes improving as markets like the Middle East and China recover from a lower base. Volume growth will stem from repair and remodel as well as new construction activity. The Americas should benefit from continued improvement in AUV, driven by the mix up trend within the industry along with good pricing realization and volume growth.

The company has also acquired Tectum, manufacturer of acoustical ceiling, wall and structural solutions for commercial building applications that will enable it to expand its leading portfolio of durable, sustainable and acoustical solutions. Tectum is a perfect fit with its strategy to expand into adjacencies and to accelerate presence in the high-growth category of architectural specialties which grew in double digits in 2016.

Armstrong World was recently selected to provide ceiling solutions for the Metropolitan Transportation Authority's East Side Access megaproject, the largest transportation construction project underway in the U.S. This marks the third win for the company in a series of large transportation projects in Manhattan.

The company focuses on improving sales dollars per unit sold, or AUV, as a measure that accounts for the varying assortment of products and geographic mix impacting revenues. The company drives AUV achievement through innovation and providing new product enhancements with market-leading features and attributes. These new products drive AUV through both better mix and better like-for-like pricing. In the Americas, there has been a broad-based recovery in non-residential markets with growth in both new construction and broader-based R&R activity with nearly all U.S. territories showing positive volume growth. This improvement is expected to continue 2017 as well.

The company’s Total Acoustics products, which were launched in the fall of 2015, continue to be among the fastest-growing products in portfolio. Building on the success of the Total Acoustics, the company has added some of the popular Architectural Specialty product families, Metalworks and Woodworks, to the Total Acoustics line. The customers now have more options as they focus on designing beautiful spaces with superior sound absorption and blocking characteristics that deliver industry-leading acoustic performance. Innovation remains the key that will continue to enable the company to provide higher-value products to the market that will ensure higher AUVs and higher margins.

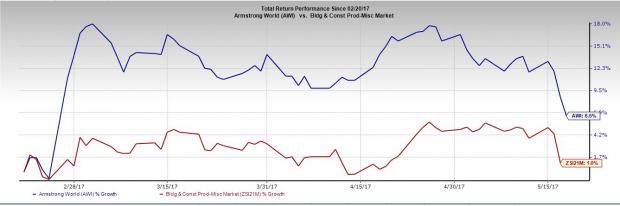

In the last three months, the stock has outperformed the Zacks categorized Building & Construction Product - Miscellaneous sub industry. The stock has gained 6.5%, while the industry has increased a meager 1%.

Estimates for Armstrong World have moved up in the past 30 days, reflecting the optimistic outlook of analysts. The earnings estimate for second-quarter fiscal 2017, fiscal 2017 and 2018 have all gone up in the last 30 days.

For second-quarter fiscal 2017, the Zacks Consensus Estimate for earnings has gone up 4% in the past 30 days and is pegged at 71 cents, depicting year-over-year growth of 27.14%. The estimate for fiscal 2017 inched up 1% to $2.71, reflecting 18.5% year-over-year growth. The Zacks Consensus Estimate for fiscal 2018 also moved north 2% to $3.02, projecting 11.4% year-over-year improvement.

Armstrong World currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Some other top placed stocks worth considering in the same sector include TopBuild Corp. (NYSE:BLD) , Masco Corporation (NYSE:MAS) and Ply Gem Holdings, Inc (NYSE:PGEM) . TopBuild has delivered an average positive earnings surprise of 5.98% in the trailing four quarters. The stock flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Masco Corporation and Ply Gem Holdings carry the same rank as Armstrong World and have delivered a positive average earnings surprise of 3.53% and 8.15%, respectively.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Masco Corporation (MAS): Free Stock Analysis Report

TopBuild Corp. (BLD): Free Stock Analysis Report

Ply Gem Holdings, Inc. (PGEM): Free Stock Analysis Report

Armstrong World Industries Inc (AWI): Free Stock Analysis Report

Original post