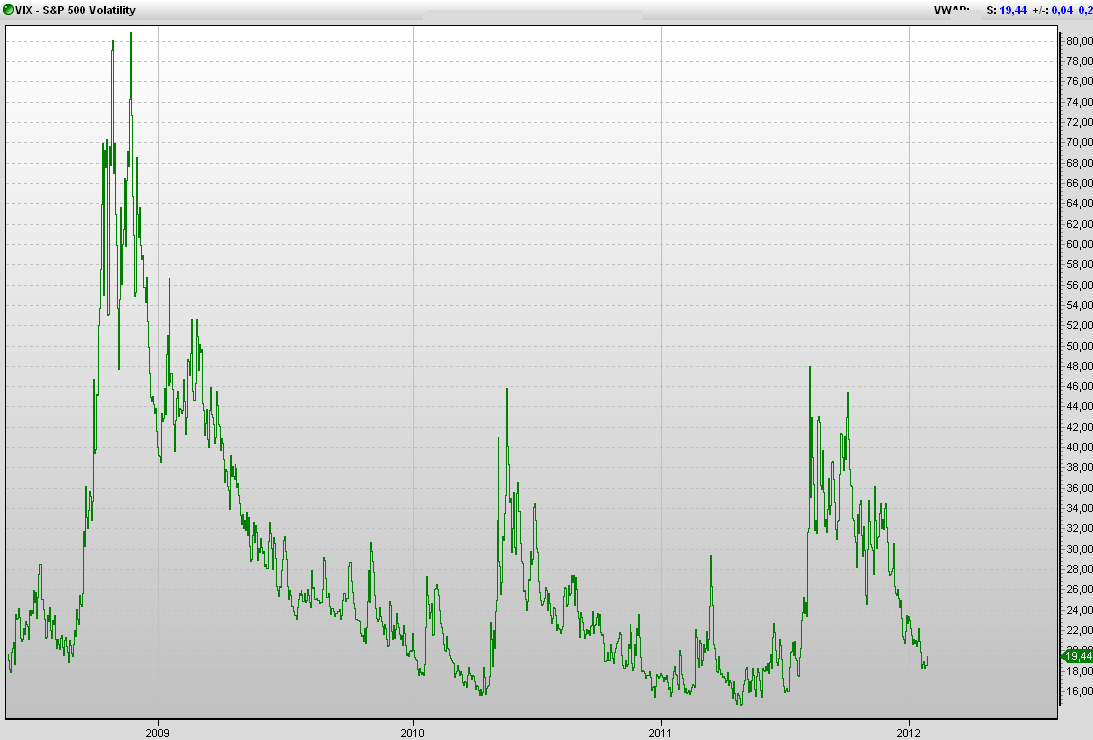

Many readers have been writing to us lately asking about the VIX. Below is an article, from Whaley, the VIX creator himself. Enjoy the reading.

To begin, VIX is an index, like the Dow Jones Industrial Average (DJIA), computed on areal-time basis throughout each trading day. The only meaningful difference is that it measures volatility and not price. VIX was introduced in 1993 with two purposes in mind. First, it wasintended to provide a benchmark of expected short-term market volatility.

To facilitate comparisons of the then-current VIX level with historical levels, minute-by-minute values were computed using index option prices dating back to the beginning of January 1986. This was particularly important since documenting the level of market anxiety during the worst stock market crash since the Great Depression—the October 1987 Crash—would provide usefulbenchmark information in assessing the degree of market turbulence experienced subsequently. Second, VIX was intended to provide an index upon which futures and options contracts onvolatility could be written. The social benefits of trading volatility have long been recognized. The Chicago Board Options Exchange (CBOE) launched trading of VIX futures contracts inMay 2004 and VIX option contracts in February 2006.

In attempting to understand VIX, it is important to emphasize that it is forward-looking, measuring volatility that the investors expect to see. It is not backward-looking, measuring volatility that has been recently realized, as some commentators sometimes suggest.

Conceptually, VIX is like a bond’s yield to maturity. Yield to maturity is the discount rate that equates a bond’s price to the present value of its promised payments. As such, a bond’s yield is implied by its current price and represents the expected future return of the bond over its remaining life. In the same manner, VIX is implied by the current prices of S&P 500 inde options and represents expected future market volatility over the next 30 calendar days.