The following are the latest weekly positions updates on Societe Generale (PARIS:SOGN)'s FX Quant Fund, which runs systematic currency strategies by SocGen's quant analysts.

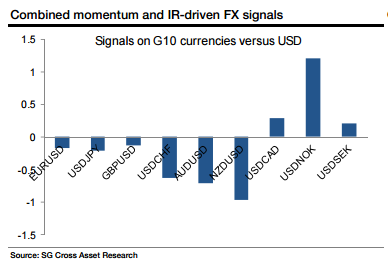

The SG FX Enhanced Risk Premia continues to be positioned for a risk-averse environment and the size of the positions has been increased over the week. The biggest longs are the USD, EUR and JPY. The most sizeable shorts are the NZD, NOK and AUD. The long yen position has been re-established during the week. The long position on USD/NOK and the short one on NZD/USD are the USD crosses with the strongest combined momentum and IR-driven FX signals.

The static SG Sentiment indicator is in the risk-neutral area but quite close to the risk-aversion border. Based on the adaptive (tailored) version of the sentiment indicators and the relevant time-series signals, we have a short exposure to G10 and EM carry. The Asian carry basket remains closed.

The risk of the aggregate strategy has been reduced and stands at around 6% annualised volatility. The strategy has been profitable during the week (+65bp) and the return so far in September is +70bp.