The following are the latest weekly positions updates on Societe Generale's (PARIS:SOGN) FX Quant Fund which runs systematic currency strategies by SocGen's quant analysts.

SOGN's FX Quant Fund which runs systematic currency strategies by SocGen's quant analysts.

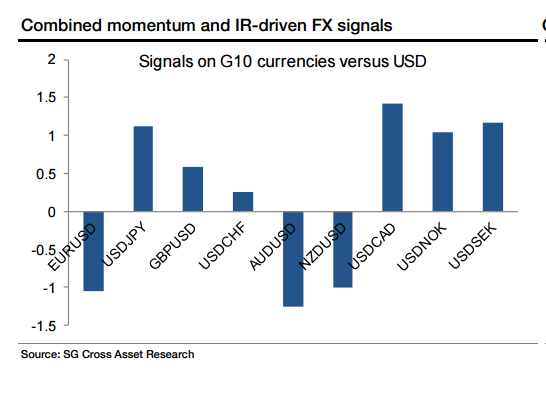

There have been no substantial changes in the positions of the SG FX Enhanced Risk Premia strategy over the week. The biggest longs have remained the USD and the GBP. The most sizeable shorts are the TWD, the CAD and the NZD. The long position in USD/CAD and short position in AUD/USD are the USD crosses with the highest combined momentum and IR-driven FX signals.

The standard SG Sentiment indicator has remained close to the risk-seeking area. Based on the adaptive (tailored) version of the sentiment indicators and the relevant time-series signals, we continue to have very limited exposure to FX carry strategies.

We have a long exposure to the G10 carry and to the Asia carry basket using a quarter of the allowed risk budget. The EM carry basket has remained closed. The risk of the aggregate strategy has been decreased even further and stands below 5% annualized volatility.