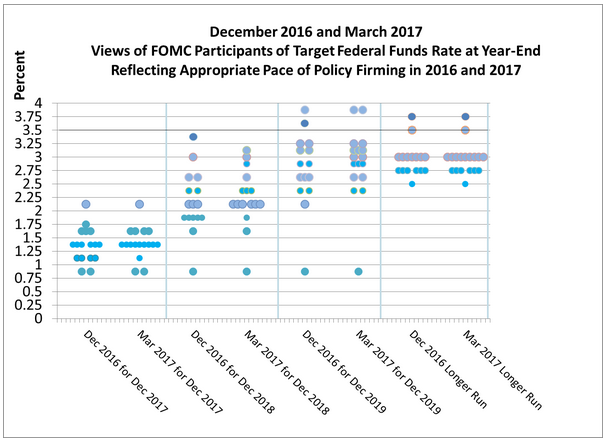

To no one’s surprise, the FOMC raised its target range for the federal funds rate by 25 basis points to between .75 and 1%. The rationale for the move was the prospect for further improvement in the labor market and the committee’s opinion that inflation will settle in at its 2% target, with risks to the outlook roughly balanced. As expected, in both the statement and subsequent press conference, it was said that future rate hikes will be 'gradual' and 'data-dependent'. The definition of gradual remained vague and Chair Yellen declined to be more precise when pressed. Some clues can be found in the new SEP dot chart, where we compare the Dec. 2016 assumed path for the funds rate target and the path seen now.

Looking at the December 2016 forecasts for 2017 at the low end of the range, there were at least six people who saw only one or two rate increases. In March, that number dropped to only three participants, with the majority and central tendency now firmly anchored to at least two more increases. Similarly, the prospects for two increases in 2018 also seemed likely to the participants.

What And When Will It Know?

The question then becomes, when are the most likely dates for the next rate hikes? The answer seems to lie in what the committee will know about the evolution of the economy and when it will know it. We need to remember that at the March meeting, the Committee had only the revised number for Q4 real GDP, which was an unremarkable 1.9%. That outcome was generated before December’s quarter-point increase in the target federal funds rate range was put in place. The committee won’t receive the first reading on Q1 2017 GDP until just before the May 2–3 meeting and that number will not have been affected to any significant extent by the committee’s March decision as it occurred near the end of the quarter.

Do we know anything about the economy’s likely performance in Q1 2017? The Fed’s Beige Book suggests that growth was modest to moderate, which would put it at about 2%. However, the widely followed GDPNow estimates produced by the Federal Reserve Bank of Atlanta has first-quarter GDP growth at only 0.9%, far below the bottom range of blue-chip consensus forecast. The GDPNow forecast has declined steadily in recent weeks from a high of 2.5% on February 22 to 0.9% on March 15, driven in part by a broad series of less-than-supportive reports on construction spending, manufacturing performance and trade, employment and price data. If that forecast holds up, the committee will be looking at a less-than-robust growth picture that reflects only the impact of its December rate hike yet not by its March decision.

What this suggests is that while the committee will claim that its May meeting will be “live,” it won’t have a good reading on Q2 2017 real GDP growth until after its July 25–26 meeting. In June, there will be another set of SEP forecasts, but a true picture on where the economy is and has been for the first half of the year won’t be available until the September meeting. This timing suggests that if there are two more rate hikes in 2017, they will most likely come in September and December, when the committee will have a reading on Q3 GDP. Of course, all of this is contingent upon incoming data on how the economy is evolving.