Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Welcome. The trend of corn (LON:CORN ETF) is a function price, volume, and energy. CORN is used as a corn proxy because the computer requires real-time volume figures. Corn's trend can be used to trade CORN, futures, or options.

What's corn's trend? According to the market, it's consolidation or nothing. The Matrix most recent, output for corn, as you know, is the following:

Matrix Line 24

While corn's daily trend is downside alignment breakout (BO), it remains in consolidation for the weekly and monthly trend. The computer defines this disagreement as no alignment, or no designation after it's name. COM tells us that corn's trend is highly compressed across all three-time frames. This increases the odds of a bigger move ahead, a move that pushes the composite trend from COM to EXP or expansion.

Corn's alignment; therefore, is consolidation. COM says this designation won't last for long, and the primary trend is closer to upside alignment than down, but we'll have to wait and see.

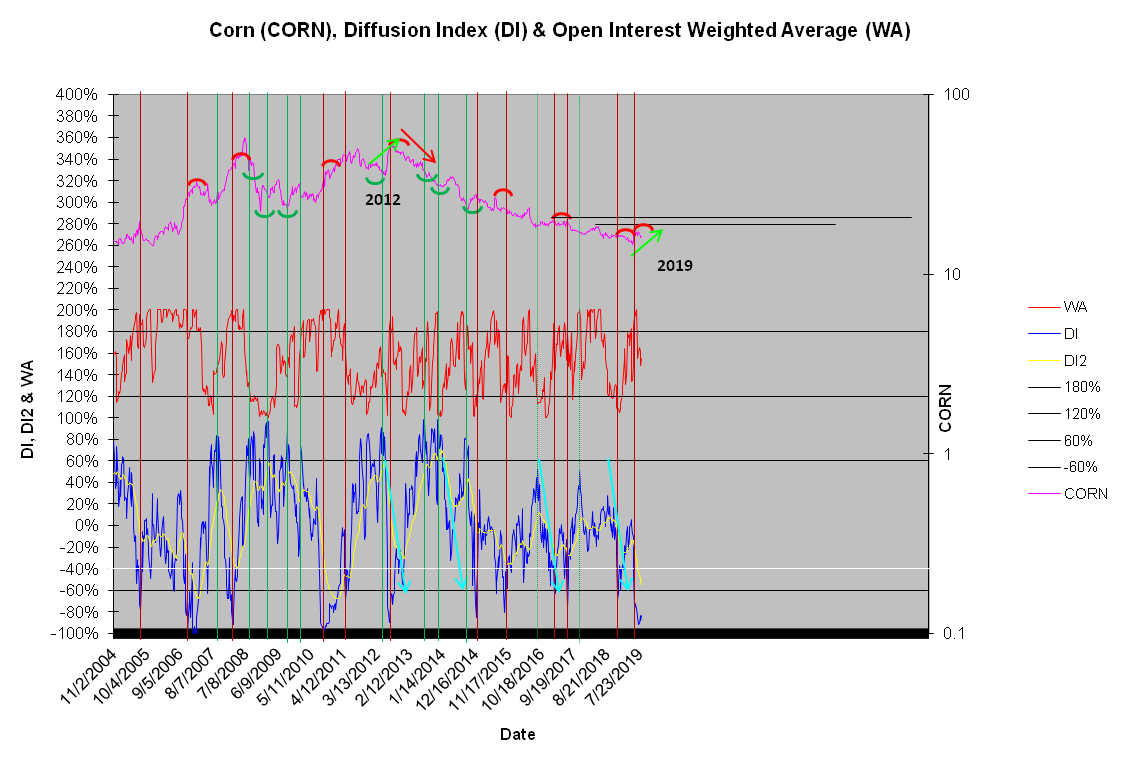

The reason why corn sold off sharply after May when everyone was bullish, was ENERGY. Corn's DI fell below -60% in May and reached nearly -100% in July. These readings defined a bearish setup or massive distribution against the bullish consensus. It's the reason why I warned the bulls to remain cautious despite the optimism. Corn remains defensive until DI climbs above -60% and likely will not rally until DI approaches 60% or higher. High DI is the energy needed to turn price and volume. Corn's DI chart is also located in the Matrix. Click the link for the cloud chart.

Corn DI

Will Corn low DI provide enough energy to turn the trend to double or triple downside alignment? It's possible, so we watch and wait. If triple downside alignment materializes, the selloff will likely accelerate.