The Fed has a dual mandate: grow jobs and fend off inflation. It seems simple and noble. Do what you can with monetary policy to keep prices stable and get more people working. If you are working and prices are stable you can live more comfortably. But like everything that has been around for many years there are numerous ways to make it complicated. For example there are at least 6 different measures of the unemployment rate. And we take a survey to find out what it might be. In an era of big data I am surprised we do not know the exact number on an hourly basis.

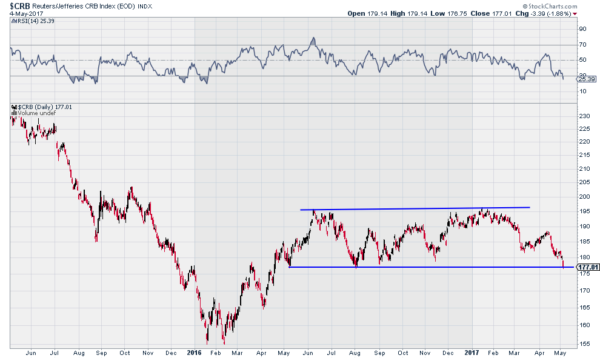

Now look at inflation. There used to be one or two measures of prices: the CRB Index and GDP Price deflator. The GDP price deflator looks at everything en mass and is then not so useful as not all parts of the country use all of the same goods and services. The CRB Index is more focused on things people (not governments or companies) buy. And it is also more commodity focused. It contains food stuff, energy and some widely used metals. It may not be the best measure of inflation but it is broad and applicable. It is also showing no risk for growth.

While the monkeys are sitting around talking about controlling inflation the chart actually is moving lower. On a short term basis the CRB Index has been falling since the beginning of the year. This has been withing a consolidative channel showing inflation contained over the last 12 months. If anything, the risk is that inflation maybe falling out of this channel.

Rising inflation is one part of the narrative for why the Fed should raise rates. And with interest rates as low as they are there is an argument to raise them when the markets do not seem upset about that happening. So if the Fed raises rates at the June meeting Chairman Yellen will likely talk about inflation moving up toward target levels. Evidence suggests otherwise.