There has been much talk about the impact of Obamacare on employment dynamics in the USA. Much of the recent discussion centers on the Obamacare definition of full-time employment:

The law defines a full-time worker as an employee who works at least 30 hours per week with respect to any month.

My interpretation is that any business must provide health insurance if it employs 50 or more full-time employees – but only to full time employees. Businesses are exempt from providing health insurance to part-time employees. But Obamacare’s definition of full-time employment is 5 hours per week lower than the BLS definition of a full-time worker (note that the establishment survey’s defintion of employment comes from the Current Population Survey):

Full-time workers (Current Population Survey and American Time Use Survey) – Persons who work 35 hours or more per week.

Logic dictates that all things being equal:

- the average hours worked per temporary worker will decline to be well below 30 hours to avoid any potential costs of Obamacare;

- the number of temporary workers will increase because the same total number of manhours worked per employer is necessary.

…… that have 10 to more than 500 employees, the 2012 National Survey of Employer-Sponsored Health Plans, predicts that the average per-employee cost of health coverage will rise about 6.5 percent in 2013 and that 58 percent of employers surveyed plan to shift costs to their employees to reduce the increase, says George Lane, principal at Mercer, the human resource consulting company that conducts the annual survey.

As an economic observer, I tend to gravitate towards the principle of unintended consequences (good and bad) when a major shift of methodology occurs. Both business and employees will alter to optimize their return – and if the above statement from Newsweek is absolutely true, then one would expect even permanent positions be downgraded to temporary (working under 30 hours per week).

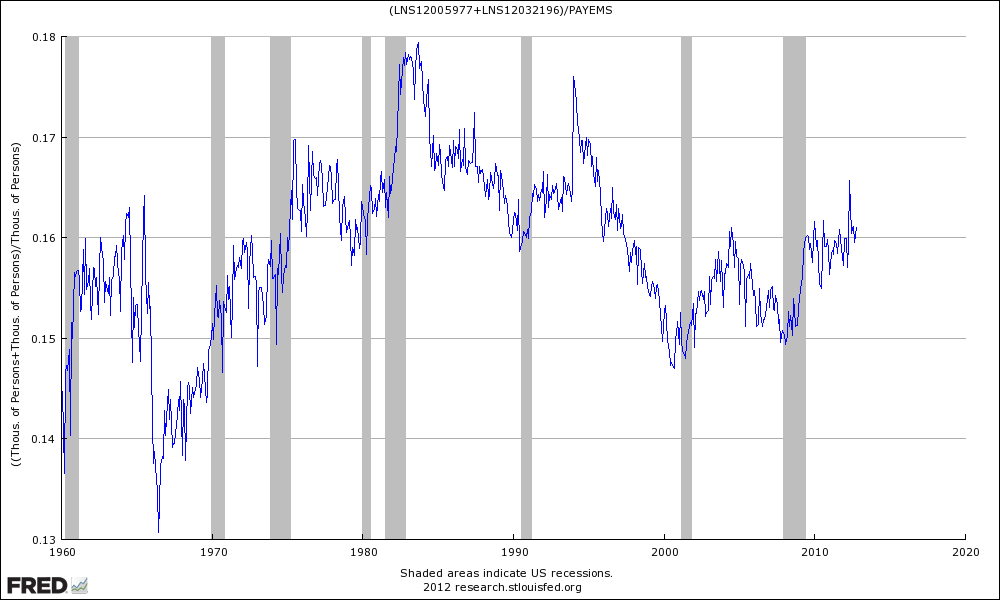

The predicted result of the effects of Obamacare would be a change in the ratio between temporary and full time employment. The ratio is currently high for the 21st century, but about average for the period since 1960. Part-time employment is in a long term uptrend since 2000.

Ratio Between Part Time Employment and Full Time Employment

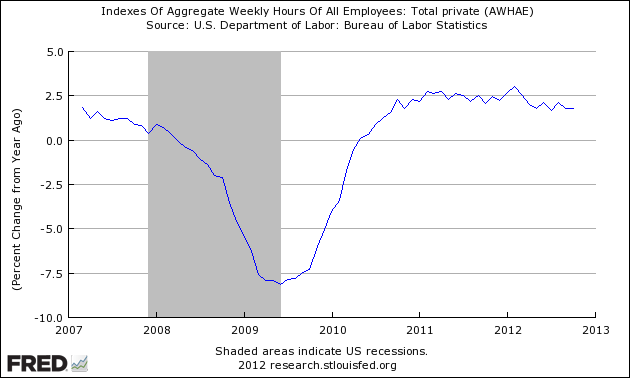

Another way to view the effects of Obamacare is to watch the total hours worked which has been been growing at a slower and slower rate since the middle of 2010.

Percent Change Year-over-Year Non-Farm Private Weekly Hours Worked

Bookmark this post. The graphs above auto-update on our website with each new BLS jobs report. My belief is that part-time employment will continue to grow for many more reasons than Obamacare – the most obvious is a demographic shift where those retiring want a part time (versus full time) job to add some spending money and to keep busy.

Other Economic News this Week:

The Econintersect economic forecast for November 2012 showed barely moderate growth, but the the underlying data used to forecast was very mixed. To use a technical term – the data was wacky, and as an analyst leaves me with an uncomfortable feeling. However, the good data was stronger than the bad data, and our alternate forecasting tools validated our forecast.

ECRI is still insisting a recession is here (a 07Sep2012 post on their website). ECRI first stated in September 2011 a recession was coming . The size and depth is unknown. The ECRI WLI growth index value is enjoying its eleventh week in positive territory. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

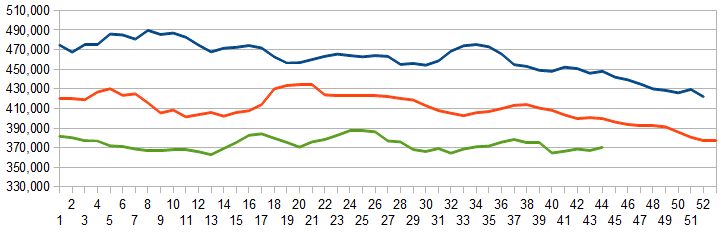

Initial unemployment claims fell slightly – from 363,000 (reported last week) to 355,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – rose slightly from 367,250 (reported last week) to 370,500. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2010 (blue line), 2011 (red line), 2012 (green line)

Bankruptcies this Week: Homer City Funding, Privately-held American Suzuki Motor, Monitor Company Group Limited Partnership

Data released this week which contained economically intuitive components (forward looking) were:

- Rail movements (where the economic intuitive components indicate amoderately slightly expanding economy).

- ISM Services business activities subindex weakened but remains in expansion territory. There is no clear trend.

- The imports portion of the trade balance was very bad (YoY decline). This is not a good indicator.

Click here to view the scorecard table below with active hyperlinks.