Well, the end is near. Potentially, we will know who the new president of the United States is in a couple of days.

With the markets trading sideways for a good while, what will break them from this go nowhere pattern? Will the election being over be enough to bring on buying or selling that will cause indices in the states and around the world to breakout/breakdown from very interesting price patterns?

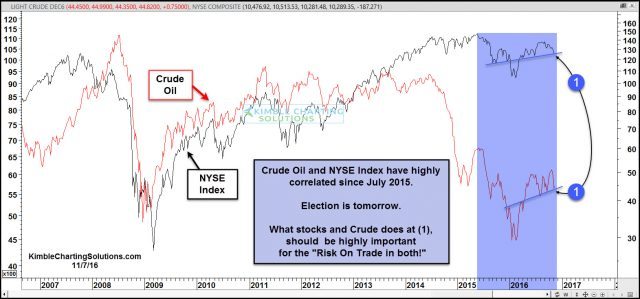

What if its not about the election? What else could market players be focusing on? Below looks at the price patterns of crude oil and the NYSE Index.

Stocks and crude oil have NOT always been highly correlated and sometime the current high correlation will end. While they remain highly correlated, keeping a close eye on crude could be beneficial for portfolio construction going forward.

At this time, crude oil and the NYSE index both remain testing rising support, which could be the right shoulder of a year long reversal pattern (inverse head & shoulders). The risk on trade in stocks wants/needs support to hold at (1).

Without knowing who will win the election tomorrow, we can’t help but feel, what crude and the NYSE does at (1) going forward, will have a huge impact on portfolio construction.