Alcoa Co. (AA), the world’s third largest producer of aluminum has had an awesome quarter. Since they beat analyst expectations in October the company’s stock is up over 29.5%. Despite low aluminum prices in 2013, the company still managed to turn a profit in each of the past 4 quarters and EPS has been growing year over year. Alcoa will report its next earnings release after the market closes Thursday, January 9th and buy-side and independent analysts are expecting more YOY profit growth.

The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

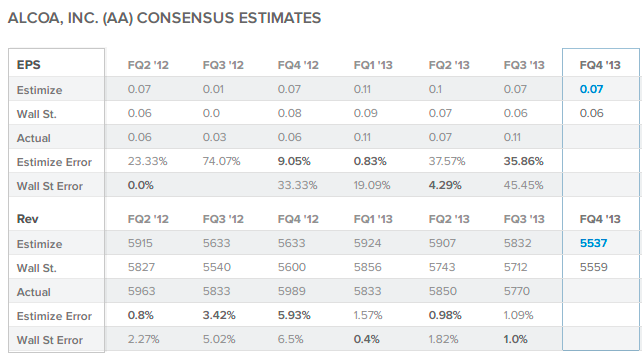

The current Wall Street consensus expectation is for AA to report 6c EPS and $5.559B revenue while the current Estimize consensus from 18 Buy Side and Independent contributing analysts is 7c EPS and $5.537B revenue.

Over the past 6 quarters the Estimize community was more accurate in forecasting Alcoa’s EPS and revenue 4 times each. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, students, and non professional investors Estimize has built a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations.

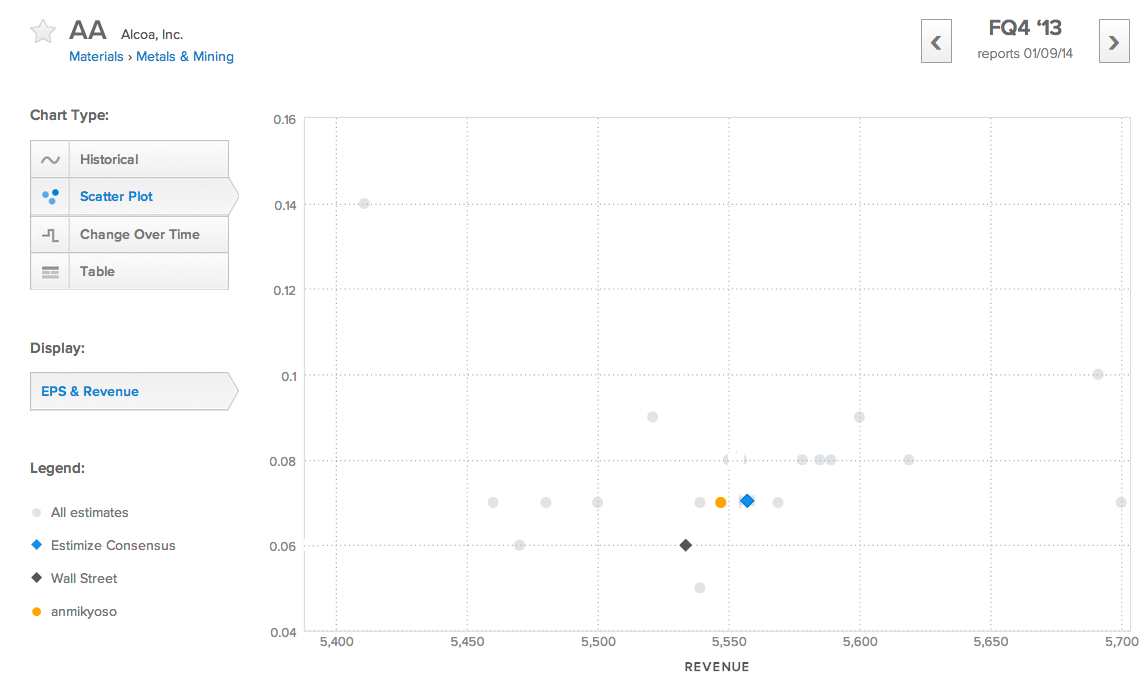

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a small differential between the consensuses.

The distribution of estimates published by analysts on Estimize range from 6c to 8c EPS and $5.460B to $5.700B in revenues. This quarter we’re seeing a smaller distribution of estimates for Alcoa. The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A smaller distribution signaling the potential for less volatility post earnings, a greater vice versa.

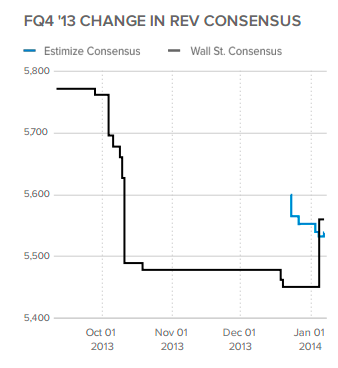

Over the past 4 months we have seen both groups revise their revenue estimates and are converging upon a relative agreement in the range of $5.55B. The timeliness of estimates is correlated with accuracy, so these recent revisions are a good indicator that Alcoa will likely report revenue in this ballpark.

The analyst with the highest estimate confidence rating this quarter is anmikyoso who projects 7c EPS and $5.547B in revenue. Estimate confidence ratings are calculated through algorithms developed by our deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case anmikyoso, who is ranked 30th overall among 3400 contributing analysts, is making a bullish call expecting Alcoa to beat the Street on both profit and revenue.

This quarter the Estimize community is expecting Alcoa Co. to beat Wall Street on both the top and bottom line. Throughout the past 6 quarters AA has met or exceeded the Wall Street profit consensus 5 times and the Estimize contributing analysts are expecting them to produce another stronger than expected quarterly earnings report Thursday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What Hedge Fund Analysts Expect from Alcoa

Published 01/09/2014, 01:46 AM

Updated 07/09/2023, 06:31 AM

What Hedge Fund Analysts Expect from Alcoa

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.