Forget about a recession. Right now, we’re in a full-blown global depression. At least, we are if heavy machinery sales are any indication.

I’ll explain...

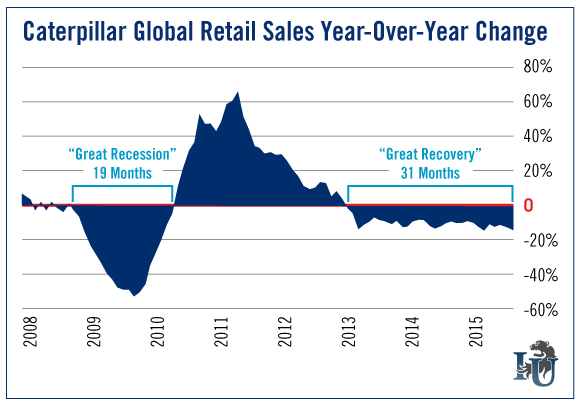

As you can see in this week’s chart, the world’s largest equipment maker, Caterpillar Inc. (NYSE: NYSE:CAT), has endured a 31-month stretch of negative sales growth. Compare that to “only” 19 months of negative growth during the 2008 financial crisis.

The pullback suggests a lack of new construction - a bad sign for overall economic sentiment. And it isn’t just happening here in the States. A 50% drop in Latin American sales coincides with the ongoing collapse of several emerging markets.

It’s an eerily familiar story.

During the Great Depression, U.S. GDP fell around 30%, prompting a halt in construction and mining projects. Industrial production was cut in half. More than 2 million construction jobs vanished. And let’s not forget oil prices. In the spring of 1933, the price of heavy crude fell from $0.87 to $0.44 per barrel - or $14.59 to $7.88 in today’s prices.

The forces affecting Caterpillar now? Slowing global GDP growth... lulls in mining operations... layoffs due to oil and gas rig closures... and a more than 50% drop in oil prices.

But before you panic, there are some differences.

For example, unemployment rates within the U.S. are low - only 5.3%. During the height of the Great Depression, unemployment was 25%.

Currently in the U.S., life expectancy is longer... quality of education and standards of living are higher... working hours per week have decreased... the list goes on and on. So, while Caterpillar may have fallen on hard times, the rest of the country is doing just fine.

Still, the drop in heavy machinery sales - and construction projects - is well worth keeping an eye on.

As far as Caterpillar shareholders are concerned, there may be a light at the end of the tunnel. If oil prices pick up, as Energy & Infrastructure Strategist David Fessler is predicting, the company could be in for a major comeback.