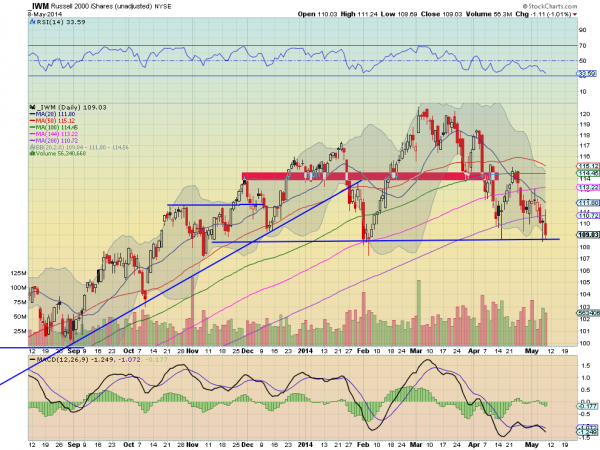

I see hundreds of chart interpretations daily. And many of them deal with an answer to this question. So, you would think it would be easy right to answer right? Well actually it is not so clear in practice. In today’s market with the PowerShares QQQ (NASDAQ:QQQ) and iShares Russell 2000 Index (ARCA:IWM) making lower highs and testing support like the chart of IWM below the interpretation tends to be something like this: “The more times the trend line is tested the more chance it will break. This market is ready to melt down.”

But, if I showed you the chart of the DIA below and asked the same question we get a very different answer. It tends to be along these lines: “The inability to make a new high clearly shows that the market is tired and ready to pullback. Time to move to cash.”

Does this mean that if a price tests resistance a lot of times it is bearish but if it tests support a lot of times it is also bearish? Testing resistance is always bearish? I am pretty sure that is not how I learned it.

There are two thing to take away from this example. First, despite attempts from technicians to lock out anything but the price action there is an inherent downward bias in the current market. That cannot be helped, so don’t beat yourself up for it. But do understand it and realize that you may be wrong. And that leads to the second take away. A trend line is a trend line because it has shown itself to be one. I am not trying to be profound but think about what that means. It is a tend line and you drew it because the price action told you that these levels are important. So why are you so willing to accept that in one scenario (testing resistance) but not the other (testing support). Both trend lines should remain important and respected until they are broken. And, you need to bring your mind back to the point where it can accept that one or the other or both or neither may hold the next test. There are no hard and fast rules. I like to say that technical analysis provides points of reflection not points of inflection. Pay attention when a price reaches a trend line and be ready to act. But do not assume what it will do.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.