It's the first Friday of a new month and that means only one thing - its non-farm payrolls. All eyes will be front and center when April's US monthly jobs report is released in a few hours. For a period or time the market will have forgotten the developments in the Ukraine. Once the impact of the US release is over many will return to cover the possibility of European event risk over the weekend before saying adieu to this Euro holiday shortened week.

The NFP headline print will round off a week that happened to report the second worst quarter for US economic growth since the supposed recession ended nearly five full years ago. Every employment report is touted for various reasons as being important and this one is no different. Q1 was a disaster in terms of growth and many investors would be asking if this is a start of sustained economic weakness or whether we will see strong acceleration in Q2.

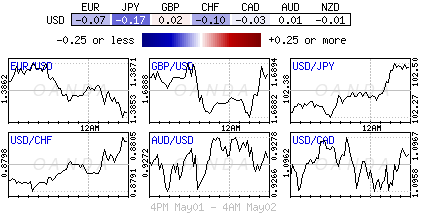

No matter what, let's hope this morning's non-farm payroll print gets to create some volatility in forex-land. Being confined to endless tight trading ranges is making the life of an FX trader rather dull and for some even difficult to make a living. Dealers and investors thrive on volatility. However, market odds favor a print that being close to expectation will send forex traders back to the 'new' reality - confined trading ranges, which seem to be the new norm created by currant central bank monetary policy.

Many investors and dealers alike are optimistic on the headline print - the consensus is +218k for payrolls and +6.6% for the unemployment rate. A print north of +200+ is possible, especially after the weather started to become less severe in mid-February. It was then that jobless claims saw a big improvement through the mid-April employment report survey period. This would suggest a significantly reduced pace of firings recently. With layoffs declining and hiring rates somewhat steady (reference the ISM survey) is probable proof enough that US net job growth has accelerated. This should push for a temporary pickup in NFP to a pace somewhat above the recent trend just above +200k a month.

When it comes to the report do not just look at the headline print - the details and backwardation is just as important. Strong hours worked in March in manufacturing (levels only exceeded during WWII) and construction (workweek improved a full hour) would suggest a need to step up hiring in those sectors, while service and leisure will be boosted by the weather. Many analysts are leaning towards an unemployment rate improving because of job growth improving being combined with a steady to marginally higher labor force participation rate - +6.6%. However, as per usual the US participation rate remains the wildcard.

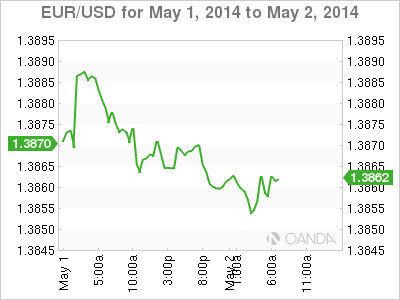

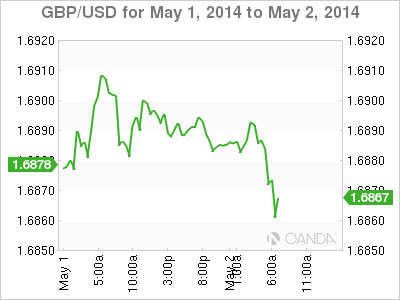

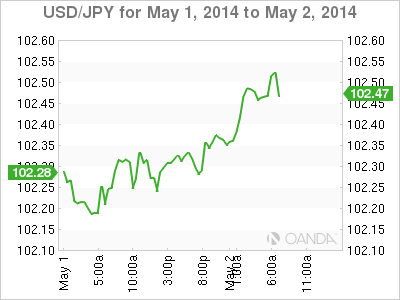

Any optimistic data will favor the dollar somewhat- the surprise support for the EUR/USD, GBP/USD or JPY/USD will come from a much weaker headline or deeper revisions. Otherwise, something close to expectations and we will have a market keen to shut up shop early with much of Europe having already taken a long weekend and Japan about to begin one. The new typical Friday will not have many individuals going out on a limb for various political and event risks - so far, Ukraine military operation have had a limited impact on European markets.

Next week the market would prefer to contest the possibility of ECB officials most liking having to talk the EUR down from the psychological €1.4000 level, with the likelihood of sterling breaching £1.7000 and JPY infiltrating sub ¥102 territory when liquidity is back to near normal conditions - a late Friday in Europe with half manned desks does not seem like the ideal dealing scenario!