The housing sector, both new and used homes, is well below peaks from before the Great Recession. Is this an effect of weak economic growth or simply reflecting demographic change?

Follow up:

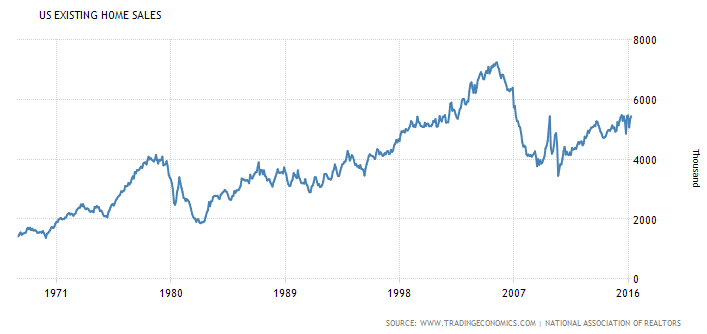

Existing home sales appear to be plateauing roughly 2/3's to 3/4's of the pre-recession peak.

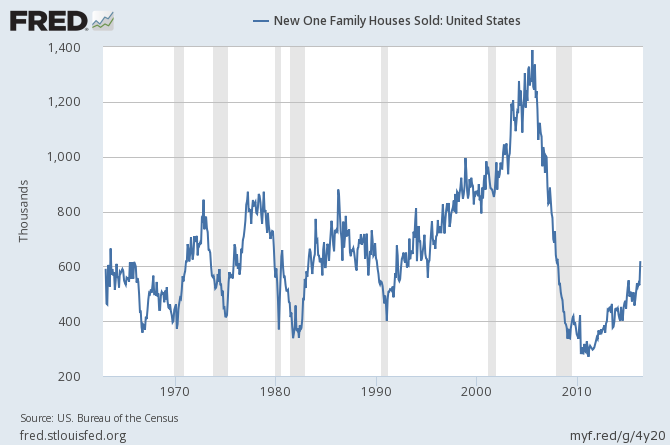

New one family homes sold (not including multifamily structures) is less than half of the pre-recession peak (multifamily housing is currently the strength in this series).

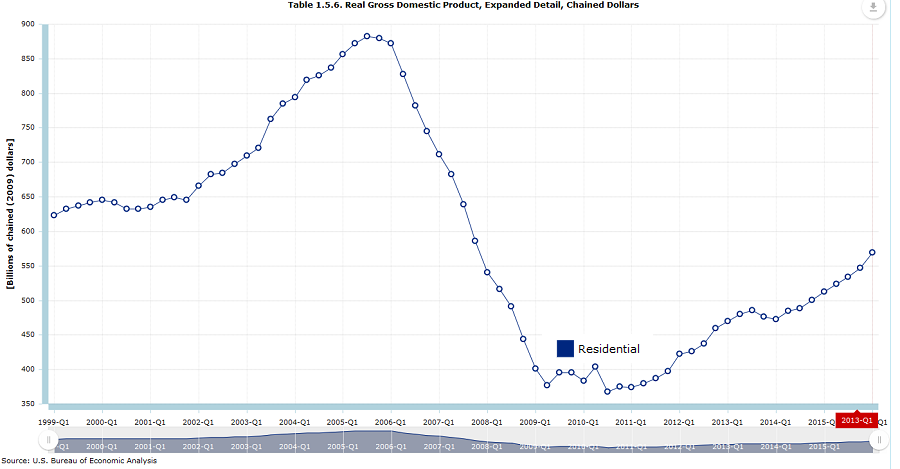

And new home sales contribution to GDP is only 2/3's the pre-recession peak (existing home sales are not included in GDP).

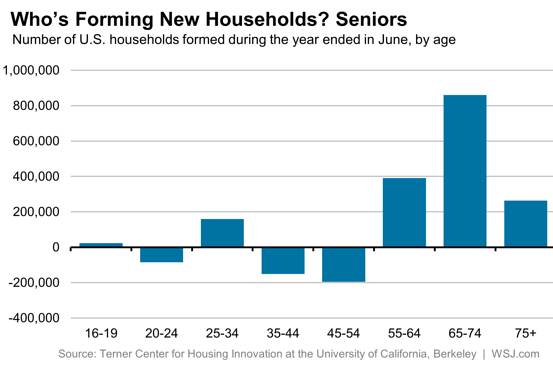

There are many dynamics which are affecting home sales - especially the changing tastes of the generations. The boomers generally are downsizing.

The majority of Generation X have formed their households. Millennials seems to have urban tastes with a higher propensity to rent than the previous generations.

| Generation Name | Births Starting | Births Ending |

|---|---|---|

| Baby Boomer Generation | 1945 | 1964 |

| Generation X | 1961 | 1981 |

| Generation Y - The Millennials - Gen Next | 1975 | 1995 |

| Generation Z | 1995 | 2015 |

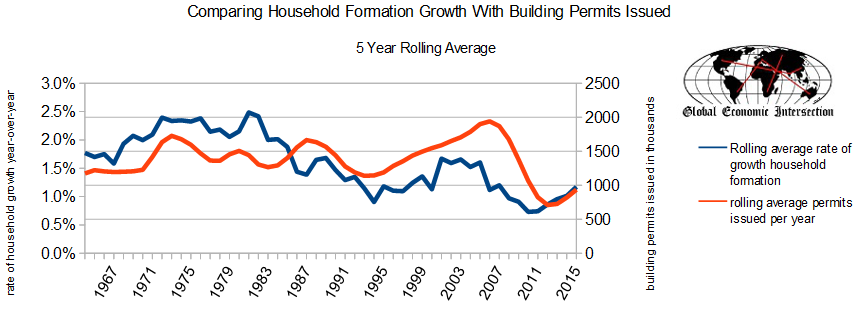

Consider that the most significant dynamic impacting home sales is household formation which is nearly half the rate seen in the 70's and early 80's.

Household formation data used in the above graph is from US Census and includes UNMARRIED and same sex people living together.

My take on economic relevance

Household formation has been trending up recently. I used 5 year rolling averages for the data to smooth out this fairly volatile data so that trends would be more obvious. If the current trends continue, household formation rates will recover in 10 to 15 years. Whether this happens or not is beyond my capability to analyze.

Much of consumer spending is household driven - especially for home purchase or renting a home.

A major contributor to the USA's (and the advance economies in general) weak economic growth relates to household formation. New households spend a lot more money than established households. Much of the significant economic growth seen in the 70's and 80's was a direct result of increased spending resulting from household formation.

Other Economic News this Week:

The Econintersect Economic Index for June 2016 marginally dropped into contraction. The index is at the lowest value since the end of the Great Recession. Note that an industrial output, non-monetary data set used to build the index has been swapped as the previous set became too volatile for accurate trending. Reflecting on the potential that a recession is underway (or soon to be underway) - I find the prospect unlikely (but not impossible). It is more likely the economic dynamics have slowed from "muddling along" to a "snails pace". The only group forecasting better economic growth is the self serving forecasts of the Federal Reserve - as well as the components of GDP which do not translate to a better world for those on Main Street. For the near future, one may need a microscope and a micrometer to measure any improvement, but further deterioration is needed to raise our assessment to probable that a recession has or soon will start.

Bankruptcies this Week: Privately-held Gawker Media, Privately-held MovieStop, diaDexus Inc (OTC:DDXS) (f/k/a VaxGen - Chapter 7)

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: