Today the public second inauguration of President Barack Obama will take place, marking the beginning of the term served by the 44th President.

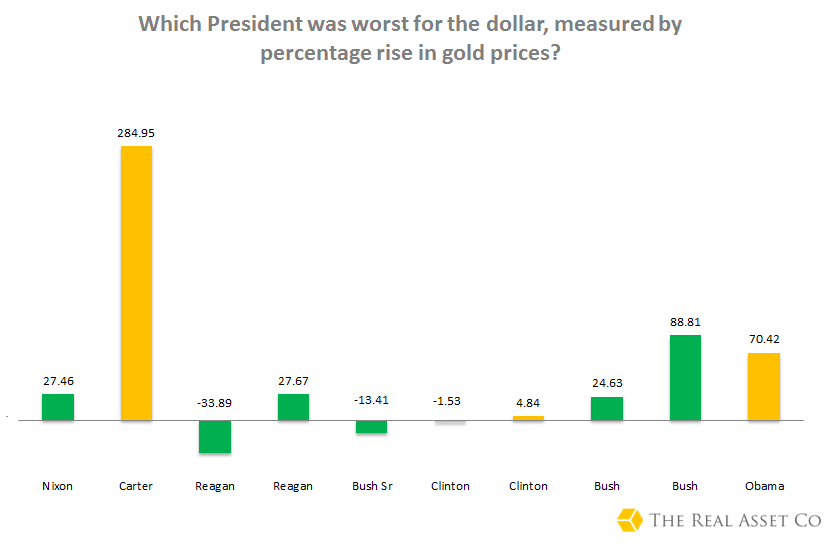

Gold has performed exceptionally well during President Obama’s term. Those in gold investment will be interested to hear he has done a better job of increasing the gold price in his first term than President George W Bush did, and carries the bronze medal for best performing gold price during any presidential term.

The new term of a president is always an interesting time, even if it’s the second consecutive term for one. The problems facing Obama now are, arguably, greater than those greeting him in 2009. But how does the gold price react? We decided to take a look at the inauguration dates of presidents since Jimmy Carter and see what the gold price does around that important date of January 20th.

We looked at the days, weeks and months surrounding the inauguration dates and assess what can tell us about gold price movements around the globe.

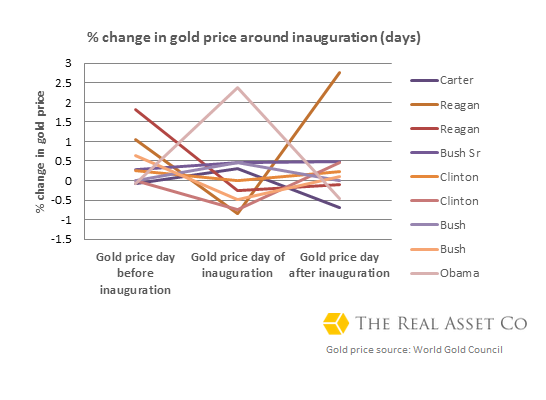

Interestingly President Obama saw the greatest percentage increase in the gold price on the day of his inauguration last year. Are we likely to see the same again today? If so then if you’re looking for a bargain, perhaps tomorrow might be a better time to buy gold.

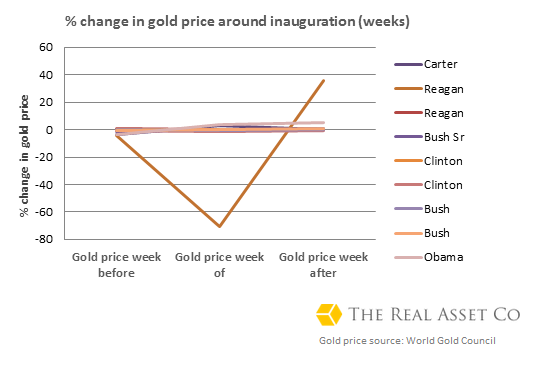

When it comes to looking at the weeks surrounding the inauguration, there isn’t much to report. From week to week very little changes, however once again with President Obama we see a small increase across the three weeks studied. Given the performance of the gold price over the last fortnight, it seems this trend is set to continue.

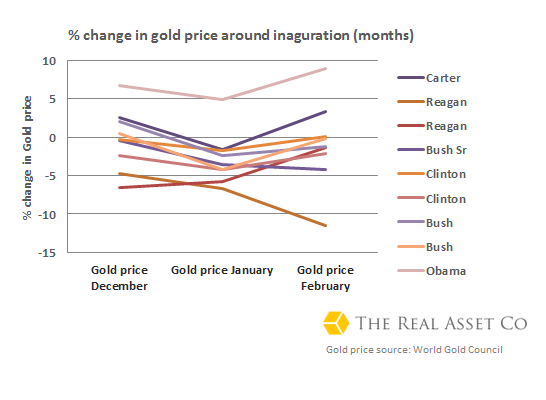

Looking at the months surrounding the inauguration, once again it appears the right man has been voted into the White House, it terms of the gold price that is. Whist Reagan’s first term outshines everyone when it comes to the days and weeks surrounding the inauguration, Obama sees the best gold price performance in the months, posting consistent gains around his 2009 arrival at the White House.

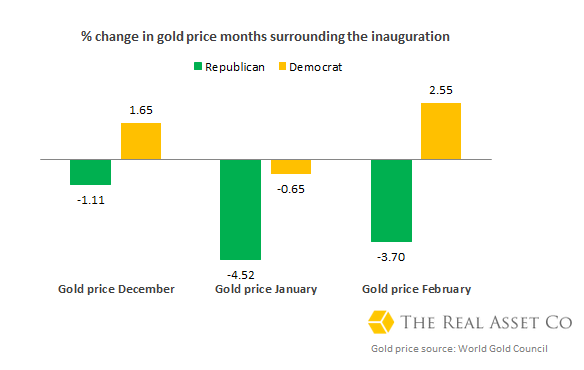

Looking at the graph, it seems this inauguration might buck the trend to earlier ones. December 2012 saw a fall in the gold price, the opposite of what happened in December 2008 prior to Obama’s first inauguration. One could argue looking at the graph that this means we will continue to see a decrease in January, and possibly February. However we believe this month will see an increase in the gold price.

The graph also shows the fall in the gold price worsening in the month of the election but improving slowing in the month following. Therefore we would still suggest this month is the time to buy gold should the price increase further in the next month. If we see similar price behaviour following Obama’s last inauguration then we expect the gold price climb to continue into the next month.

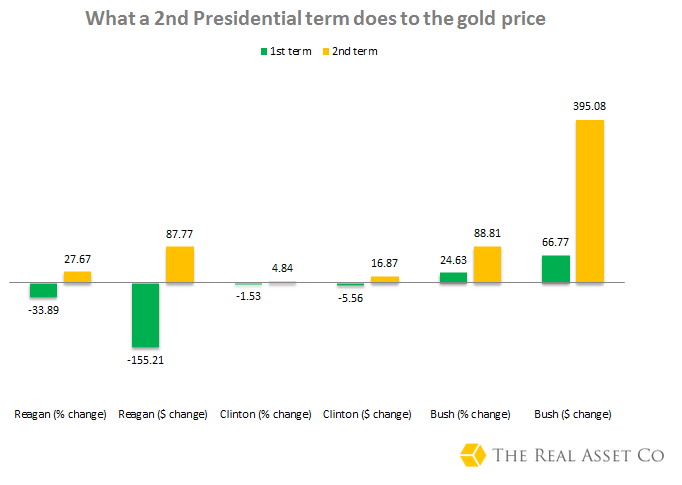

As we told you back in November, the re-election of President Obama can only mean good things for the gold price. During the election we carried out research which found that those presidents serving a second consecutive term, are guaranteed to see a greater increase in the gold price, due to the fact that they appear to become inherently inflationary in their pledges and policies.

The good news is that it looks like we’re voting in the right President if you’re thinking about gold investment.

Considering a Democrat is entering the White House, we thought it was important to take a look and see what impact, if any, this would have on the gold price in the month of, and those before and after the election.

As the graph shows, over the last 25 years the inauguration of a Democratic President provides benefit to the gold price far more than a Republican. Whilst a new Republican President, or the prospect of one, always sees a decrease in the gold price, Democratic Presidents provide a healthy boost to the yellow metal in the months before and after they ascend to the White House.

Whilst it may be too late to place your bets around gold’s price behaviour in the weeks and days surrounding the election, it’s not late to think about the next couple of months or in fact the next four years.

As we have shown, presidents continue to build upon the last administration’s desire to devalue the US dollar; this is particularly strong when the president is a Democrat in his second term. Given this information, and that we expect the gold price rise to continue into February, one would suggest that the beginning of Obama’s term would be the time to buy gold before he’s got any chance of devaluing the dollar even more.

Disclosure: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What Does Inauguration Day Mean For The Gold Price?

Published 01/21/2013, 06:18 AM

Updated 05/14/2017, 06:45 AM

What Does Inauguration Day Mean For The Gold Price?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.