Summary

The problems in Hong Kong continue (emphasis added):

On a Hong Kong street corner, a young protester found himself staring at the end of an angry police officer’s handgun. He was shot.

Across town on an overpass, a middle-aged man argued with rowdy protesters, accusing them of lacking patriotism for the Chinese motherland. He was set on fire.

Months of antigovernment protests have thrown the Chinese territory into its worst political crisis in decades, with no end in sight. The movement, which started as a fight over an extradition bill, has morphed into a broader call for democracy and police accountability in the former British colony. But neither side seems to agree on what the future should look like under Chinese rule — and neither seems willing to compromise.

The Hong Kong economy has contracted for two consecutive quarters, which is the technical definition of a recession. Despite a very low unemployment rate of 2.8%, retail sales have shrunk for the last eight months. Although manufacturing PMI has been below 50 for the last 12 months, industrial production is still growing. Hong Kong is the gateway city for mainland China; there's only so long that Xi and the Communist party will let this continue before upping their response (data from tradingeconomics.com)

UK GDP increased in the 3Q19 (emphasis added):

GDP grew steadily in the third quarter, mainly thanks to a strong July. Services again led the way with construction also performing well. Manufacturing failed to grow as falls in many industries were offset by car production bouncing back following April shutdowns.

Looking at the picture over the last year, growth slowed to its lowest rate in almost a decade.

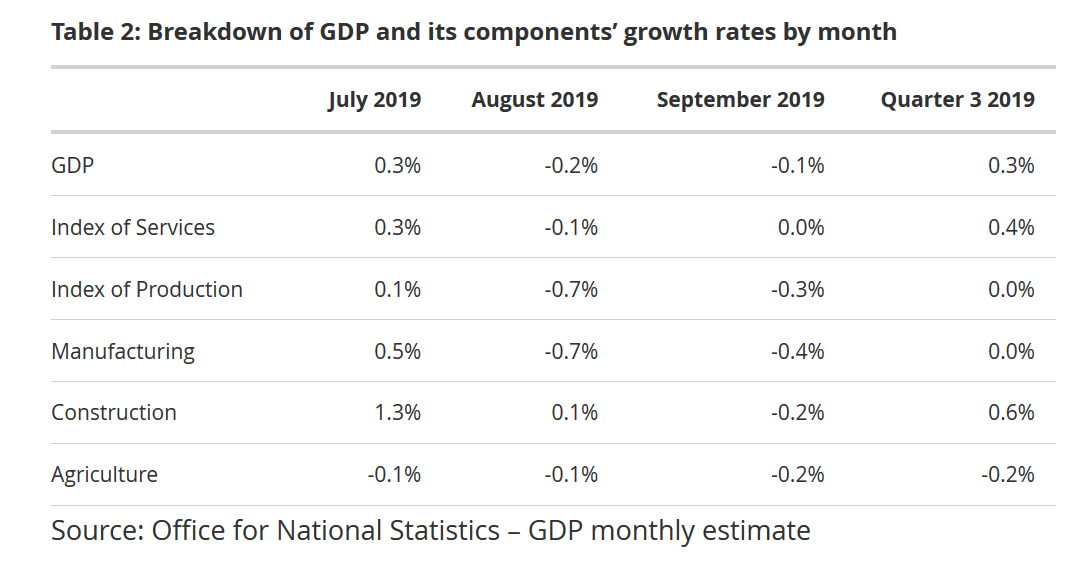

The following table fleshes out the report:

While the news media reported the data positively, I'm a bit more sanguine. August and September were very weak relative to July; if the July data hadn't have been so positive, the quarter would have been far worse.

The problems continue in South America (emphasis added):

Former President Evo Morales on Monday encouraged resistance to efforts to form a transitional government leading to fresh elections in Bolivia after his resignation prompted violent protests by many of his supporters.

“You never abandoned me and I will never abandon you,” Mr. Morales wrote on Twitter from an unknown location only hours after he was forced to step down. “The world and patriotic Bolivians will repudiate this coup.”

Almost simultaneously, a leading opposition politician who has emerged as a possible interim leader of the country said she was ready to take the reins of power until new elections could be held.

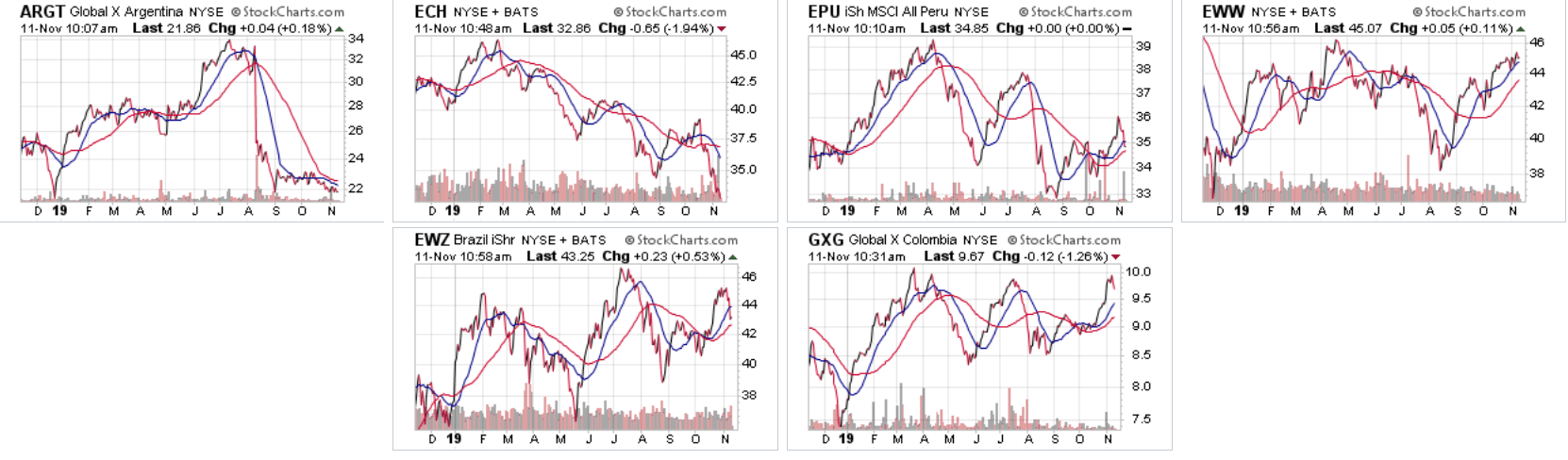

Brazil is struggling with slow growth; Argentina is in the middle of a debt crisis; Colombia's rebels are re-arming; China had to cancel a major international event due to local unrest; Mexico is in a technical recession. This has caused mixed performance among the region's equity markets:

Argentina, Chile, and Peru (top row, three from the left) are all in the lower third of their respective charts. The other countries are in better shape.

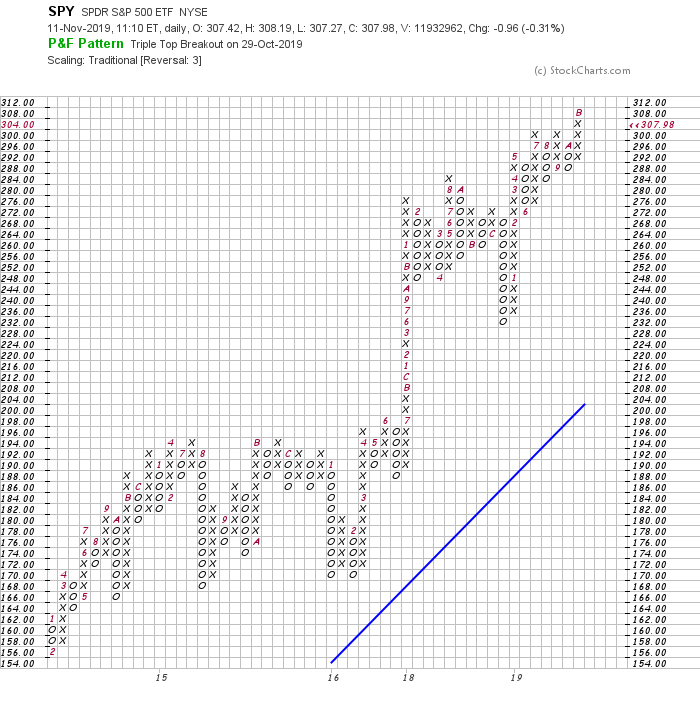

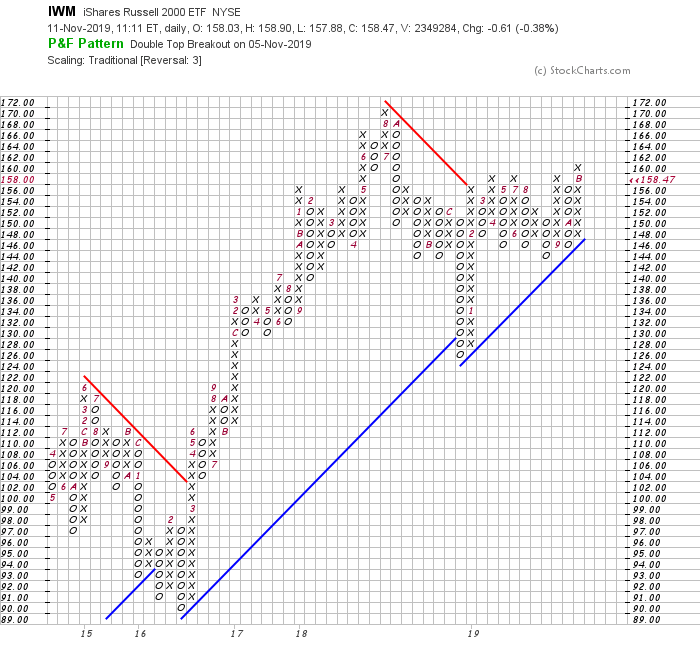

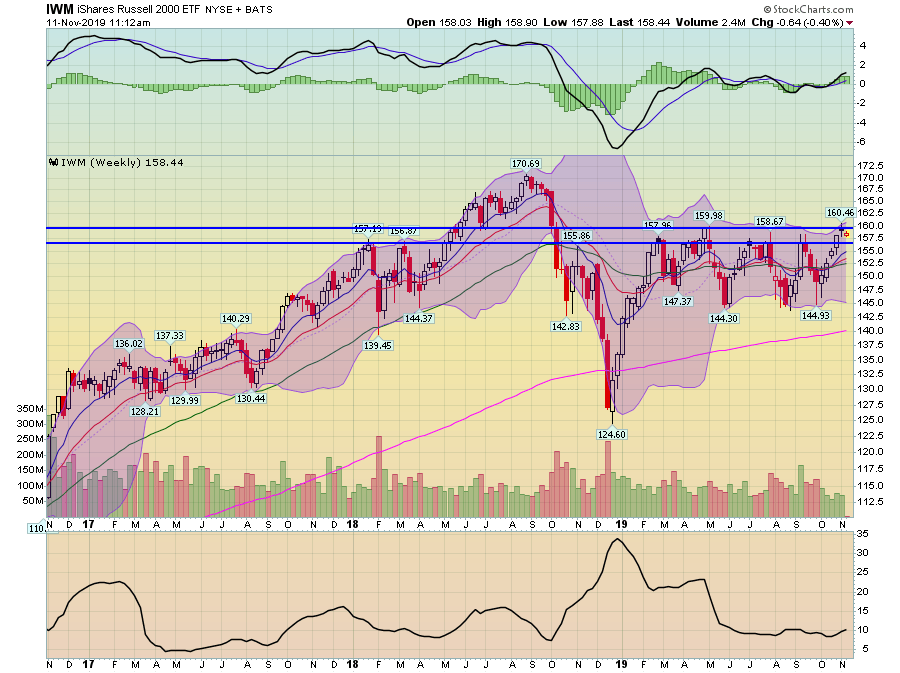

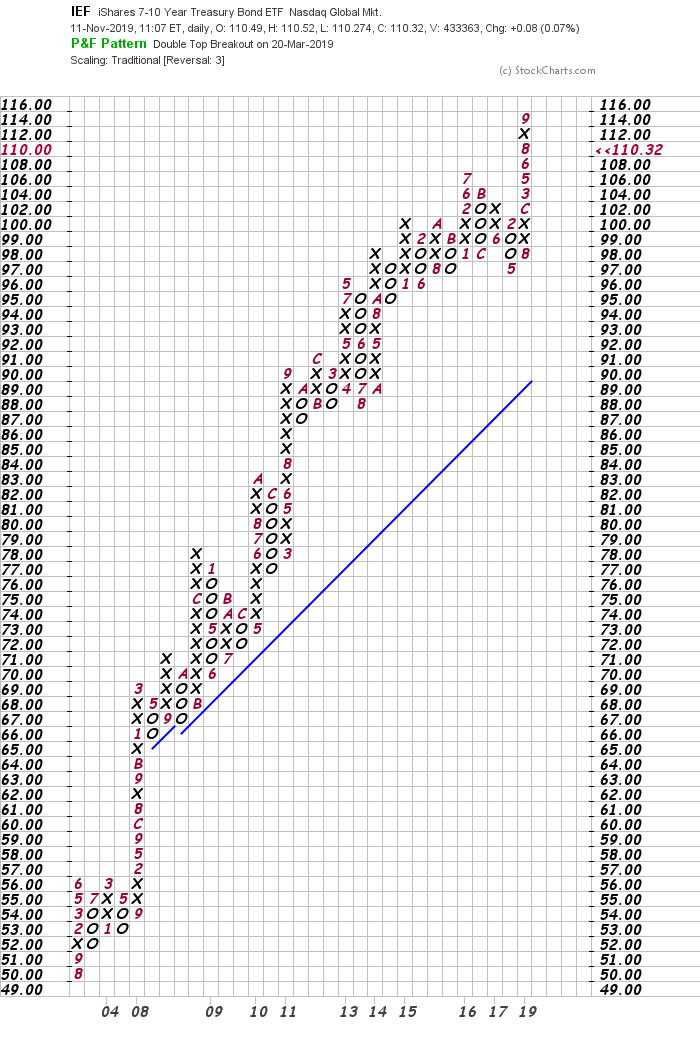

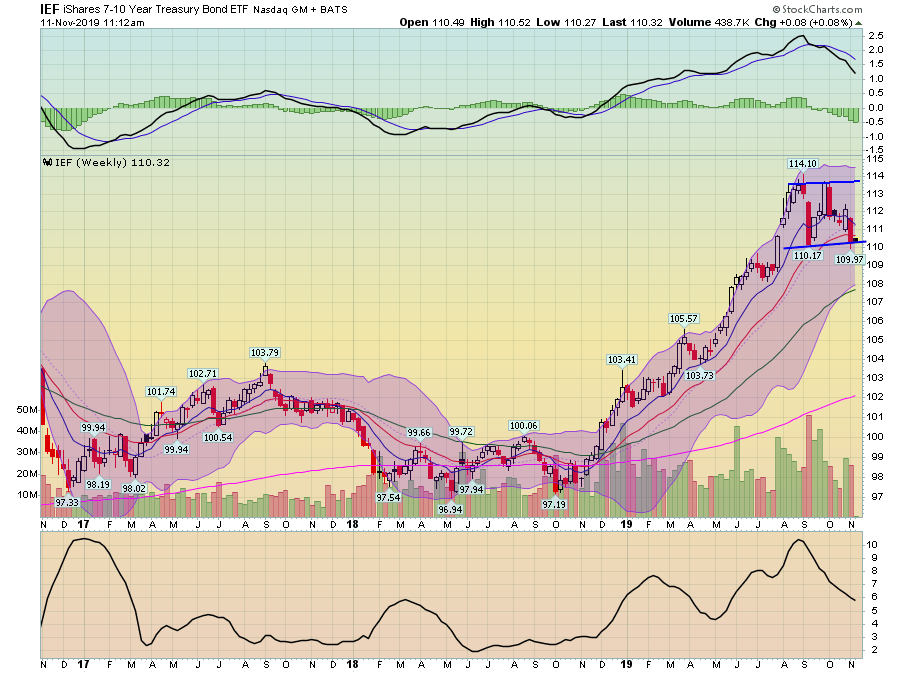

Today, I'll be looking at the P&F and weekly charts of three major indexes: the SPY, the IWM, and the IEF. This will put recent price activity into a broader context.

Let's start with the SPY

The SPY is near a five year high, which is clearly shown on the P&F chart.

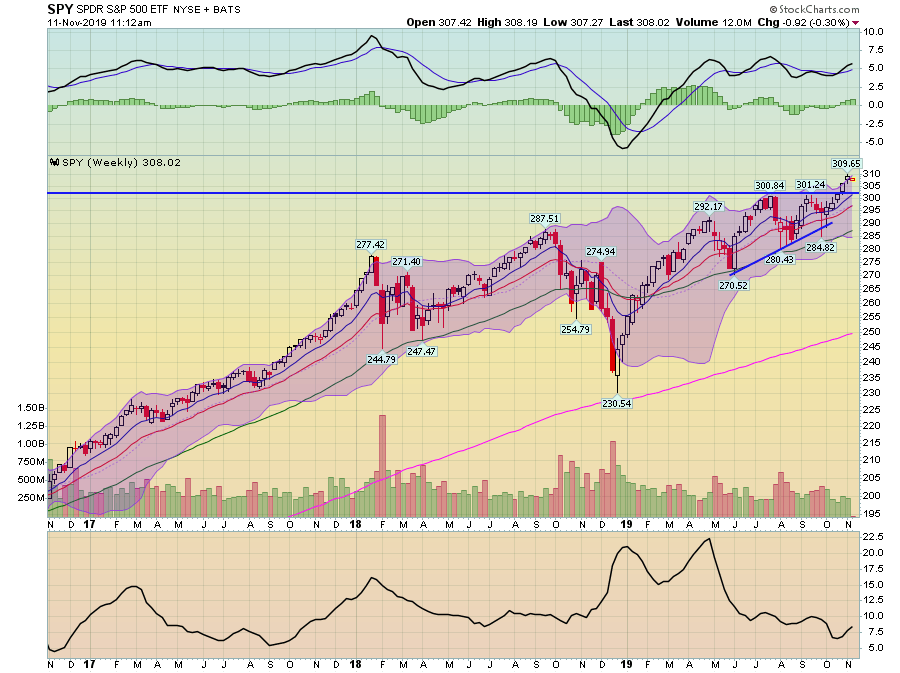

On the weekly chart, prices formed a rising wedge pattern, which shows that over the last few months, traders started to bid shares at increasingly higher price levels, meaning they thought the overall value was rising. Prices are now through resistance and are near 5-year highs.

The IWM is still trading in the 158-160 range, where it has found resistance for most of this year. Prices are still below highs from 2018.

On the weekly chart, there are two key technical highs. Prices are right below the highest.

The IEF is still trading near multi-decade highs.

On the weekly chart, the IEF is forming a consolidating rectangle pattern; prices are currently near the lows of that pattern with declining momentum.

So, what does this data tell us? First, the Treasury market is still at high levels, which is decidedly risk-off in nature. That could change with a move through support. Second, the large-cap orientation of the rally indicates a cautious approach to risk. Weak 4Q19 GDP projections from The NY and Atlanta Fed mean this trend is likely to continue. Third, we could be near an important change in market tone, which would happen if the IEFs break through support and/or the IWMs move through resistance.