Another election is in the books. And the pollsters proved pretty accurate this go-round, with few surprises from the ballot box.

We were left with two major takeaways from the 2018 midterm elections. One is that Democrats will be in charge of the House in January. The other is that Republicans held on to the Senate. Despite initial hints of a bilateral infrastructure plan in 2019, I’d like to make a bold prediction...

The catchphrase for 2019 will be “partisan divide.”

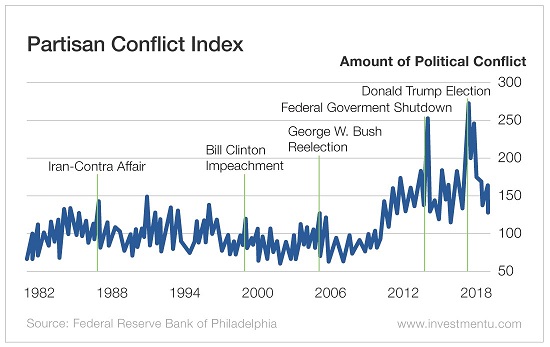

The Federal Reserve Bank of Philadelphia actually keeps tabs on this sort of thing. Its Partisan Conflict Index tracks political disagreement. It does so by monitoring the rate of newspaper articles printed about political conflict on the federal level.

So why does the Philadelphia fed track this? Its research suggests that with amplified political conflict comes increased financial uncertainty among businesses and households.

The Philly fed (Phed?) contends that political uncertainty leads to slowed economic activity with reduced consumer spending and business investment.

An easy-to-follow (albeit slightly ridiculous) example is if legislative hostility prompts people to sock money away in a savings account instead of using it to buy something like cheesesteaks from the classic Philly institution Pat’s King of Steaks. Pat’s, in turn, buys less Cheez Whiz. And the share price of Kraft Heinz (Nasdaq: NASDAQ:KHC) takes a hit. Behold the power of uncertainty.

That’s not to say that markets - and cheesesteak sales - are headed south just because of a partisan clash. Investors have all but ignored political bickering the past couple of years. But it couldn’t hurt to hedge your bets now that a partisan divide is on the horizon... just in case consumer spending and the markets slow down.

The best part? You can still make out even if the market keeps up a bullish pace.

Meet Your New Best Friend, Put Selling

The mere mention of options is enough to make most casual investors head for the hills. But not all options are created equal. And this one is about as safe as it gets. Here’s how it works.

Take one of the blue chip stocks in your portfolio. Search for a put option with an expiration date about a year out and with a strike price 20% below the current value of that stock. So for a stock trading at $125, look for a strike price near $100. (A strike price is the price at which shares of an underlying stock can be sold by the option buyer.)

From there, place a sell order for that option and collect the income. It’s a strategy that is exceptionally low-risk and straightforward... But it's not without a downside.

You are selling something... and on the other side of that transaction is a buyer.

What they've bought from you is the right to sell you shares of that company at the strike price if the stock's price drops below it. In that case, you would have to buy those shares at the strike price.

If you're using this strategy on stocks you already hold - and presumably like - then you'll end up buying those same stocks at a cheaper price. Even if it fails, you can still win.

Sounds like a good bet to me.