Stocks Tread Water While Watching Debt Ceiling Clock

The stock market was trading in an up and down fashion Tuesday as the negotiations in our capital dragged toward the October 17 deadline. From Bloomberg:

“It’s all news driven from what’s going on in Washington,” Frank Ingarra, head trader at Greenwich, Connecticut-based NorthCoast Asset Management LLC, said by phone. His firm oversees about $1.8 billion. “On minute we are closer to it and the next minute we are farther apart. In the short-term there is going to be this up and down because we are so near a high, and I would imagine it is not going to break through that high until we have a deal.”

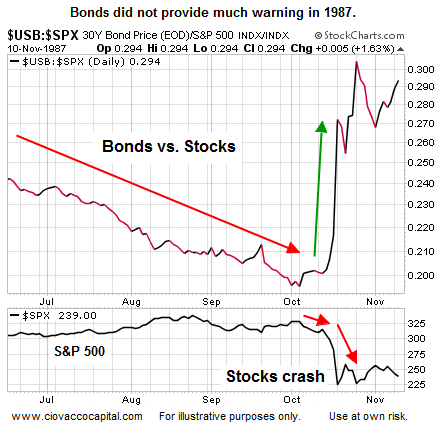

Bonds Gave Little Warning In 1987

Regular readers know we often examine risk-off vs. risk-on ratios to monitor the battle between economic fear and economic confidence. For example, prior to the 2011 U.S. debt downgrade demand for bonds was increasing relative to stocks several months before to the August 2011 waterfall decline in equities. Demand for bonds was also helpful prior to the destructive stock market decline in 2008. As shown in the chart below, in 1987 bonds were not nearly as helpful in terms of alerting stock investors.

Volatility Does Not Align With Imminent Crash

We have made the “things are not that bad” case for stocks in recent weeks with hard evidence from defensive assets, cyclical assets, and ETF leadership. However, we respect that conditions can change quickly as they did in 1987. Another piece of calming evidence comes from the volatility front. From Bloomberg:

Even with a deadline looming for the U.S. to avoid a debt default, it’s been a comparatively calm October for financial markets. Daily swings in the S&P 500 (SPY) have averaged 0.78 percent so far this month, down from 0.9 percent for Octobers over the last eight decades and less than a quarter the moves in 1929, 1987 and 2008, data compiled by Bloomberg show. Bank of America Corp.’s Market Risk Index that uses options to forecast fluctuations in equities, currencies and bonds reached minus 0.74 last week, the lowest since May 21. Stock market crashes in October 1929 and 1987 caused the market to move more than 3.5 percent a day, on average, data compiled by Bloomberg show. Equities posted a monthly plunge of 20 percent in the Crash of 1929 prior to the Great Depression and slumped 22 percent in October 1987, including a 20 percent drop on Oct. 19 known as Black Monday.

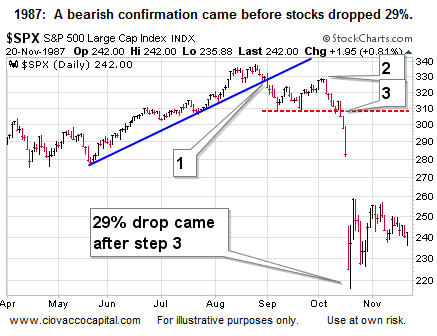

When In Doubt, Pay Attention To Price

There is a reason traders who focus on price are successful. Price captures the aggregate opinion of all market participants about future economic outcomes, earnings, valuations, systemic risk, monetary policy, the Fed, etc. While the bond market was not particularly helpful in 1987, the market’s pricing mechanism did provide ample warning before the big plunge in stocks. We have outlined the three steps needed for a bullish trend change in the past. The process works in reverse as well. As shown in the chart below, the S&P 500 completed the three steps required for a bearish trend change before dropping an additional 29% in October 1987. Step one requires the break of a bullish trendline. Step two is a lower high, and step three is a lower low.

2013 Looks Much Better

Even with the exhausting political theater in Washington, the S&P 500 has not even met the criteria for step one of a bearish trend change. As of Tuesday afternoon, the bullish trendlines, shown in blue below, have held up as expected during a rising and bullish economic trend. Yellow flags would begin to wave if the S&P 500 were to drop below 1625 in the coming days.

Negative Debt Ceiling Could Extend Positive Stimulus

The Fed’s impact on asset prices cannot be overstated, which was evident in the market’s reaction to even talk of tapering. The theory on the street says the Fed’s tapering schedule may be pushed out (again) to offset the possible economic damage from the government shutdown and the threat of a U.S. debt default. From Bloomberg:

“We expect that continued QE, at least through the end of the year, should lead to decreasing S&P 500 volatility as we approach year-end, provided that politicians in Washington arrive at a resolution on the debt-ceiling sometime between Oct. 17 and Nov. 1,” Mottl, Susquehanna’s New York-based head of derivatives strategy, said. “The debt-ceiling issue is leading many to believe that the Fed will stay on hold for longer,” Sebastien Galy, a senior foreign-exchange strategist at Societe Generale SA in New York, said via phone yesterday. “More broadly, the hit to growth and sentiment may have similar impacts on other central banks. Expansive central bank policies tend to crush implied foreign exchange volatility.”

Another “we’ve got your back” signal was given to the markets during Tuesday’s session when the little nugget below was posted on MarketWatch:

Directors at the Minneapolis Fed, in the run-up to the central bank’s September monetary policy meeting, urged their colleagues to cut the discount rate, in order to help the economy. The Minneapolis Fed wanted a quarter-percentage point reduction in the discount rate to 0.5% from the current 0.75% rate, according to a Fed release on Tuesday. This is the first time the regional bank has made the request and reflects a growing concern about the economic outlook.

Investment Implications – Bullish, But Open-Minded

As the debt ceiling clock counts down, the financial markets continue to hold up relatively well. Unfortunately, there is always the risk of someone throwing a monkey wrench into the political gears in search of a few minutes of camera time.

Politics, it seems to me, for years, or all too long, has been concerned with right or left instead of right or wrong. ~ Richard Armour

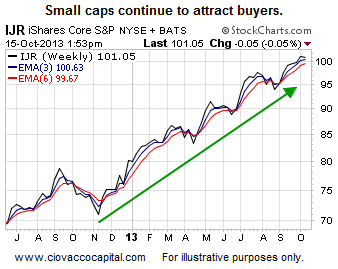

Our market model tells us our allocation between stocks and cash is prudent given the market’s bullish, but still fragile, bias. The supply and demand balance on the ETF front continues to point to many of our holdings as being prudent risk-reward options: broad U.S. (VTI), technology (QQQ), small cap (IJR), foreign developed (EFA), and emerging markets (EEM). With asset prices skewed by the Fed’s printing press and no deal nailed down on the debt ceiling, we will remain extremely flexible allocation wise over the next 48 hours.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What Can We Learn From The 1987 Stock Market Crash?

Published 10/16/2013, 12:50 AM

Updated 07/09/2023, 06:31 AM

What Can We Learn From The 1987 Stock Market Crash?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.