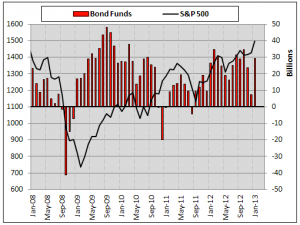

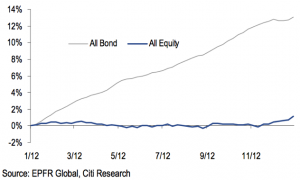

The Investment Company Institute reported that investors added nearly $500 billion dollars to taxable bond funds in 2012. Total taxable bond fund assets stood at 2,847.2 billion versus 2,381.0 billion in the year ago same period.

The trend continued in January with investors pouring another $30 billion into bond funds, while also adding to stock funds. In fact, equity fund flows in January showed some of the strongest monthly gains ever reported.

It is understandable why investors have continued to funnel money into bonds – an uncertain global economy and record low yields on money markets has made bond funds a choice only because there has been no perceived better option. Yet, many traditional fixed-income securities are, in the words of one financial commentator, offering return free risk, as opposed to risk-free returns.

And indeed, bond fund investors should be reminded that the risks are high. From a nominal peak of 15.8% in 1981 to a low yield of 1.8% in 2012 for ten year U.S. treasury bonds, bond investors have enjoyed a 30-year bull run aided by declining global inflation during the 1980s and 1990s, and a flight to quality over the last decade. In the intervening years, when bond yields did rise temporarily, coupon income was large enough to offset any capital losses arising from yield increases, except in 1994. It is worth reminding investors again that the bond market can and has delivered investors some painful blows.

“The Great Bond Market Massacre. In a year of low inflation, bond fund investors have suffered more than $1 trillion in losses. Here’s how it could happen again.”

For today’s bond fund investor, it is important to recognize that risks are asymmetrical – there is much greater risks to the downside than any opportunity for gain to the upside. It is impossible for rates to repeat the last 30 years – interest rates will not be falling by 14% from their current levels. The tailwinds enjoyed by bond investors for the past three decades are over.

Today, across many of the developed world government bond markets, real yields are razor thin or negative. In effort to resuscitate economies and sustain growth after 2008, governments in the developed world have been spending heavily and financing the resulting deficits through increased borrowing. As a result, debt-to-GDP ratios have increased significantly and exceed 100% in Japan and several European countries. At high debt-to-GDP ratios, managing debt and debt servicing costs costs can become so untenable that bond yields can rise sharply, leading to capital losses for income investors.

As a result of the most aggressive central bank monetization of debt campaign in history, the balance sheets of the major central banks have more than doubled since the crash in 2008. It is highly likely that credit risks are not fully recognized by the market. We live in a world where “real” financial markets are occluded by government central bank interventions making it difficult to discern the true price of securities. In the recent words of Jim Grant, “the financial markets have become a hall of mirrors.”

Given my cautionary view on bonds, it’s interesting that one trend-following rule I use just shifted the Vanguard Total Bond Fund to a cash position. While there is no indication implied as to whether this will turn into a long-term, important pivot for the bond market, bond investors should seriously assess their understanding of the risks they may be taking.

In the eyes of some, it may be simply prove to be an opportunity being caused a large scale “risk on” trade. Jeffrey Gundlach, manager of the DoubleLine Total Return Fund, recently commented noted that Treasury-bond market yields have moved up over the last six months , while credit market yields have dropped by a significant amount. Gundlach said that he is interested in Treasuries only for short-term investment strategies and said that “on short-term basis, the relative value of Treasuries is higher than what most people seem to want to give credit for.”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What Bond Investors Should Be Considering

Published 02/19/2013, 01:57 AM

Updated 07/09/2023, 06:31 AM

What Bond Investors Should Be Considering

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.