Dow Theory is simple, the market can’t rally without Transport (ARCA:IYT) stocks. This does hold some truth but since this theory was started the economy has changed and we have other sectors that lead the market.

So lets break down the Transports. First the Transports was one of the few sectors that was green today which is a bullish sign. Our indicator flashed this sector as oversold on Monday and has since moved away from oversold. A bounce today supports further upside if it can get above todays high at 155.22. Looking at this chart, though the Transports are resting at some serious support and over the past two days has been able to stay above this cliff of death. Buying seems to be picking up around these levels.

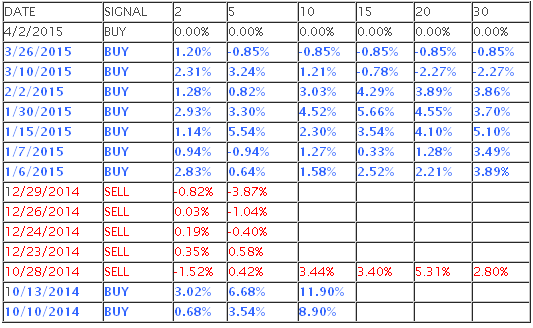

To play this sector with a normal ETF, is just as easy. IYT tracks this industry and has a similar chart. Any break below 153.50 is bearish and its bullish above 156.18. A move above 156.18 and 160 is very possible. The risk/reward here is not bad risking about 1.5% on the downside with a stop below 153.00 for a reward of 160+ on the upside. Look below at the last oversold/buy signals.