It started with pants. Guys started to pull them down exposing their underwear. Sagging pants they called it. It became a cultural thing. You saw it everywhere. Stories appeared with kids unable to run away from police as their pants kept them from moving their legs.

Then the backlash hit. Bans on sagging pants. The city of Flint Michigan even instituted a law banning sagging pants with the penalty of a fine or jail time. Maybe Flint should have been focusing on other things. It did nothing to stop the phenomenon.

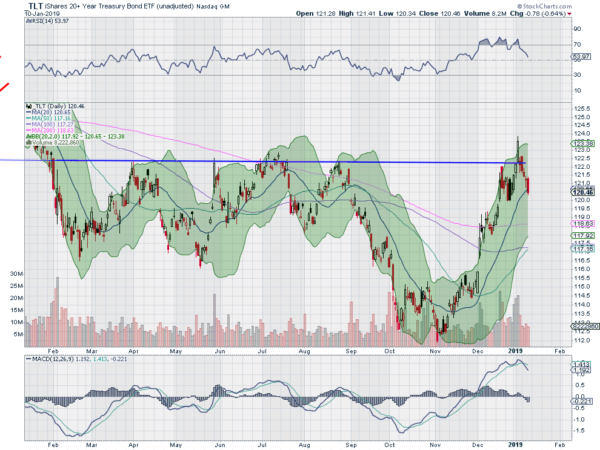

And now it is hitting the Bond market. Just a week ago Bond prices were near a 52 week high and clearing long time resistance. But since then prices have been sagging. Thursday the US Treasury Bond ETF (NASDAQ:TLT) broke below its 20 day SMA. This was the first time that had happened since mid-November.

With the long red candle Thursday a strong down week looks guaranteed. The Friday morning pre-market activity is showing a weak bounce. Will it build into a a strong one and create a bottom? Or was this move to new highs just a retest of the break down zone before a prolonged move lower?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.