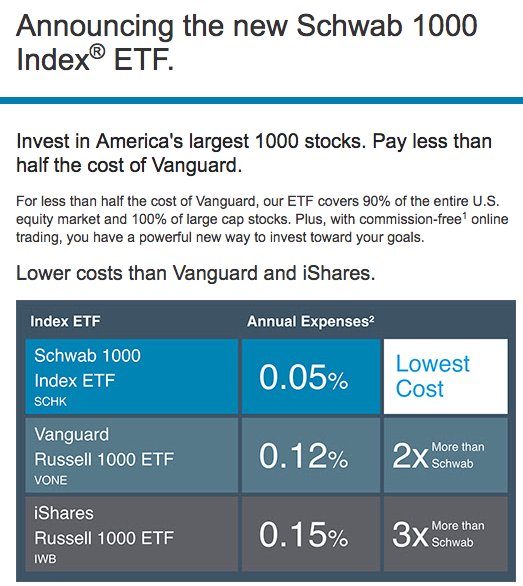

This morning I saw the graphic below posted on social media as a marketing tool for the new Schwab 1000 Index ETF (NYSE:SCHK). The intent of this message is to point out the advantageous expense ratio of SCHK in relation to its competition. The fund charges just 5 basis points per year to own the 1,000 largest stocks in the United States.

Both Vanguard and BlackRock (iShares) offer similar funds that track the exact same Russell 1000 Index for a slightly higher expense ratio. What’s often lost in this type of comparative analysis is the “most expensive” fund on this list charges just 0.15% per year. That is the real-world equivalent of $150 in management fees for every $100,000 invested.

All three funds offer an insanely low expense ratio from a historical context. Twenty or thirty years ago it would have been nearly unthinkable to charge such a modest fee. You would have laughed if someone told you that you could own 1,000 stocks in a perfectly market-cap weighted basket that re-balances itself quarterly for such a low annual expense.

Now, you’re almost considered a thief if you charge anything remotely higher. That’s how far the pendulum has swung in the other direction. There is even speculation that we could soon see an ETF or index mutual fund with a true zero expense to shareholders.

Sometimes it’s easy to forget how far we have come and how lucky we are today. You can trade for nothing, build a portfolio for nothing, and have unparalleled access to information for pennies a day.

It’s important that we acknowledge this is one of the greatest times to be an investor from a structural standpoint. Every one of us has access to vehicles and systems that provide us with unparalleled opportunities to succeed.

It’s how you implement these tools that is the greatest challenge and will continue to be even more important with each passing year. The funds will get cheaper and more efficient. The information will flow even faster. But your greatest edge will come from the behavioral choices you make with regard to deploying capital and controlling risks.

The Bottom Line

Mistakes won’t come from which ETF you choose. All three of the funds listed in the table above will get you to the same destination with little variance in net returns. It’s when you buy them, when you sell them, and how you size them that are the most important factors to your personal bottom line.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.