Investors’ enthusiasm around President Trump’s policy goals and improving rate scenario helped bank stocks perform well in the beginning of the year. However, the progress so far on these fronts has dampened the initial optimism, leading to weak trading activities.

Notably, unexpected political developments in the United States and global growth concerns kept last year’s trading activities high. The momentum continued in first-quarter 2017 as well.

While an improving economic backdrop and the interest rate hikes boosted banks’ financials, uncertainty about Trump's ability to deliver on the proposed tax and banking sector reforms, and infrastructure spending turned investors apprehensive. With banks anticipated to be one of the biggest beneficiaries from these changes, this has led to a significant reversal in the Trump-induced banking stock rally.

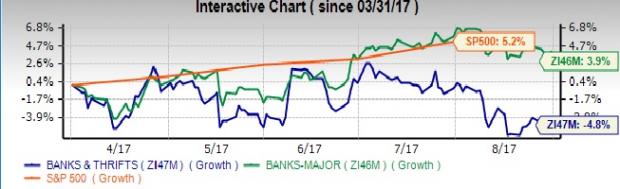

Specifically, since April, the Zacks Major Regional Banks industry recorded mere 3.9% growth versus the S&P 500’s 5.2% gain. On the other hand, the Zacks Banks & Thrifts industry incurred 4.8% loss.

For the major part of Q2, trading activities remained sluggish in the absence of any tangible development on the reforms proposed by the Trump administration, lesser geopolitical tensions and an unchanged monetary policy standpoint of the Fed. Though the market witnessed some volatility at the very end of the quarter, induced by renewed reform talks and steps, it was inadequate for banks to record any improvement in trading revenues.

The trading environment is still gloomy with low volatility prevalent in markets. Seasonally slow third quarter is also responsible for this low volatility. Recently, top executives of big banks, including JPMorgan Chase & Co. (NYSE:JPM) , Bank of America Corp. (NYSE:C) , Citigroup Inc. (NYSE:C) and The Goldman Sachs Group, Inc. (NYSE:GS) , hinted at bleak third-quarter trading revenues. Especially, lower fixed income trading is expected to weigh on the overall trading income. It is feared that this will adversely affect banks’ Q3 earnings.

On the other hand, investment banking fees have been on upswing since the beginning of 2017. This will support earnings growth for big banks. Banks are also witnessing higher fees. Moreover, improving lending margins are likely to support banks’ results.

Further, refinancing activity is projected to improve on the back of the higher rate environment. This, in turn, will stoke mortgage revenue growth.

On the cost front, banks are continuously attempting to reduce needless expenses by reorganizing business which has helped deliver decent bottom-line figures over the past few quarters. Also, results for the last few quarters show some respite from elevated legal costs, with the sharp sting of fines and penalties being cured by settlements. Though technology costs may exist, cost control efforts are likely to support the bottom line, going forward.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (NYSE:BAC): Free Stock Analysis Report

Goldman Sachs Group, Inc. (The) (GS): Free Stock Analysis Report

Original post

Zacks Investment Research