One mistake that people often make is that they react too strongly to individual economic reports. For example, recent headlines heralded a dramatic 25% jump in new home sales from September to October. And, most of the follow-up commentary trumpeted the fact that 444,000 purchases (seasonally adjusted) had been much greater than anticipated. Some investors have taken the uptick to mean that real estate sales are alive and well.

However, single month estimates are typically revised. Sales for July and August were revised down roughly 4% and 15% respectively. Meanwhile, September came in at a paltry 354,000 (seasonally adjusted). When you look at the entire picture for new home sales in the 2nd half of 2013, you’re actually seeing a huge slowdown in home buyer appetite.

What’s wrong with real estate? Interest rates spiked dramatically in the May-June period when the Federal Reserve hinted that it might begin winding down its bond-buying program. Property seekers salivated over the 3.5% “fixed for 30 years” mortgages. Unfortunately, 4.5% “fixed for 30″ has put affordability out of reach for a large segment of the population. Granted, interest rates may be low on a relative basis, and many prospects are less sensitive than first-timers. Nevertheless, price appreciation has already thinned out the pool for speculative folks.

Don’t take my word for it. From the start of the year through mid-May — while the real estate market was particularly brisk — iShares U.S. Construction (ITB) outperformed SPDR S&P 500 Trust (SPY). Since the Fed’s mention of a reduction in bond purchases (i.e. “the Great Taper”), it has been a tale of two completely different cities.

Analysts who maintain that the stock market has already “priced in” and “accepted” the eventuality of Fed tapering may be underestimating the impact of the Fed’s eventual exit from the rate manipulation game. For instance, foreign holdings of U.S. Treasuries by global central banks fell by $128 billion between April and August.

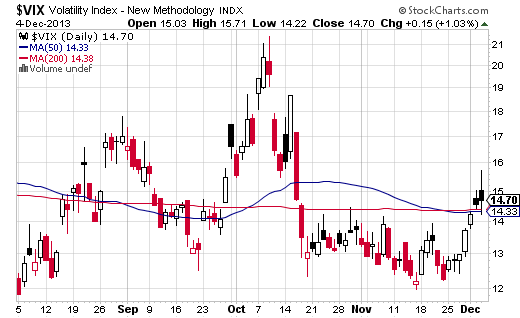

If U.S. investors are bailing on Treasury bonds that fall in price as yields rise, and foreign investors are simultaneously reducing exposure, how can the Federal Reserve taper without another substantial rate spike? Will prospective homeowners who may not be able to make ends meet at “4.5% fixed” be able to purchase at “5.5% fixed?” The recent pick-up in CBOE VIX volatility suggests that, while the bull market in stocks may not be in peril, interest rate angst is hardly “priced in.”

Keep in mind, the overwhelming majority of analysts did not foresee the 12/07-6/09 recession let alone the stock market collapse that accompanied it. What’s more, most have forgotten the fact that the Fed had raised overnight lending rates 17 times to 5.25% in 2006, curtailing the last bit of real estate speculation and contributing to subsequent home price declines. Current home prices and current stock prices do not have to be in a bubble to be adversely affected by higher borrowing costs.

One credible voice recently spoke to CNBC, lamenting the fact that the markets are trading on interest rates, not fundamentals. He should be thanking his lucky stars that the markets have traded on Federal Reserve rate manipulation, rather than earnings growth and sales. The average quarterly profit growth for companies in the Dow this year was 2.6%, while the average quarterly revenue growth was actually negative (-0.7%). Those percentages surely do not justify a 22% year-to-date gain for the Dow; Fed policy does. Understanding how Fed policy is inspiring, cajoling and in some cases, forcing investors to take on more stock risk is the key to success in our rate-sensitive rally.

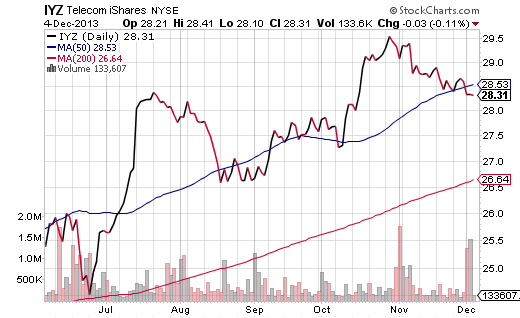

If it sounds like I am ringing the bear bell, I am not. My clients are participating in the bull market and will continue participating for as long as the Fed is capable of reining in the cost of borrowing. If it gets away from them, we will see downtrends in ETFs like iShares DJ Home Construction (ITB), SPDR Utilities (XLU) and iShares Telecom (IYZ). Eventually, bearish price movement would hit all economic segments. For now, however, longer-term trends remain favorable.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.