Investing.com’s stocks of the week

Last week the GBP grew after the April UK Retail Sales publication and the GBP/USD pair crossed the psychologically meaningful level 1.3000. On the other hand, the USD is under the pressure due to the scandal of Trump’s Administration passing secret information to Russia. The GBP grew against the USD despite the difference of the interest rater and Treasury Bonds yield differential.

At the moment, the political risks, which can be quite unpredictable, prevail over economical ones in the market: this week after the Manchester terror attack on Monday the pair begins the correction and now has reached the level of 1.2950. Early Parliament elections add come pressure on the GBP, as victory of the Conservatives is not as obvious as before. According to the polls, the gap between the Conservative and Labour parties is narrowing every day.

The pair is expected to lower further due to destabilizing impact of the Manchester attack, absence of macro-economical publications from the UK and the investors’ anticipation of the USA monetary policy tightening.

The USA Existing Home Sales and FOMC Minutes, which can reveal the outlook of the further USA interest rate increasing, will be published today.

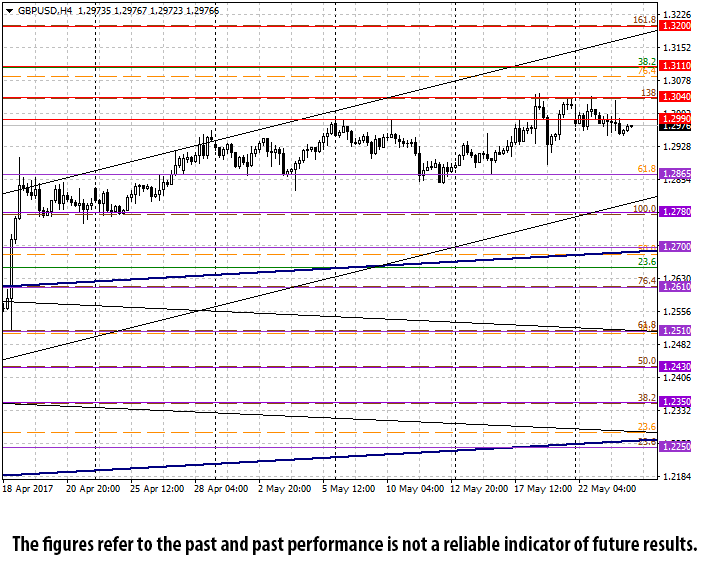

- Support levels: 1.2865, 1.2780, 1.2700.

- Resistance levels: 1.2990, 1.3040, 1.3110, 1.3200.