Outside of the sound practice that is physical gold ownership in a time of monetary gamesmanship, the precious metals sector is all about speculation, at least according to 9 out of 10 chart jockeys and momentum junkies micro managing every short-term twist and turn.

Indeed, NFTRH manages Gold, Silver, and the gold stocks on down to the short-term views as well, but that is only because the long-term views have stated that this is a time to be paying attention. Do we pay attention because we have waited so long to promote our orthodoxy and finally be right as gold bugs? No. We pay attention when a chart tells us to pay attention.

While we manage the shorter-term views (both macro fundamental and technical) rigorously in the weekly report and interim updates, here I’d like to dial out to the big monthly picture with 3 large (click to expand as needed) charts of ARCA Gold BUGS, Gold and Silver to see their stories, which are the reasons we are managing shorter-term views.

First HUI monthly reviews the warnings to the analysis from 2012 and 2013. They were very clear and should have kept people out of much of harm’s way with respect to gold stock speculation.

But with respect to the bull market (almost unbelievably volatile as it has been) that began in 2000, the very simplicity of the fact that HUI remains in a series of higher highs and higher lows (green arrows) is the bedrock reason we have interest in the potential for a strong rally at least and new bull cycle at best.

A plain and simple fact is that HUI has not declined to a lower low from 2008, despite the fact that a massive topping pattern formed from 2009 to 2012 measures to a new low. The analysis has allowed for a couple of jabs down below the green dotted trend line, but the ultimate parameter was and is a ‘higher low’ to 2008. We are not in the business of hoping or promoting. This parameter must be intact for interest in the sector to continue.

Now, Team Gold Stock Bear is calling what we think may be a bottoming pattern a Symmetrical Triangle (continuation) that would lead to a breakdown ultimately, and a loss of the higher low parameter. If that happens, so be it. People must accept reality. But another reality that gold stock bears need to consider is that it has not made a lower low and further, despite the grind (paraphrasing Gordon Gekko once again, grind is GOOD) of the seemingly endless attempted bottoming process, HUI has made progress of late, resides above the 2008 trend line and is making an attempt at the red downtrend line.

HUI Status: Grinding out a potential bottom until parameters are violated. These are the big picture technicals only. We are managing shorter-term signals and macro fundamentals weekly in NFTRH. Current bullish target (subject to revision if/as the bullish case progresses) is mid-high 300′s (old neckline resistance). Ultimate bear parameter is a lower low to 2008, although we are managing shorter-term warnings at higher levels.

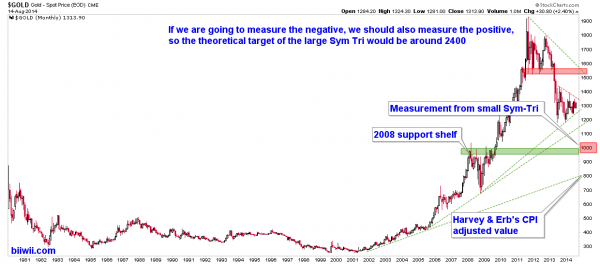

Let’s address Harvey and Erb right off the bat. The academics have gained quite a bit of notoriety with their CPI adjusted target of 800 for gold. They’ve even got a trend line in their favor.

Next in the Bear Sweepstakes is Team 1000, and these guys actually have a compelling support level (top of the 2008 pattern) to support their case. In fact, if that is a small Symmetrical Triangle (noted by the converging red and green trend lines) forming as opposed to a bottoming pattern, it measures to 1000.

But what about Team Gold 2000 & Beyond? Well, they’ve got a large Symmetrical Triangle measurement to 2400. If that is the proper interpretation then even an unsuccessful test of the upper Triangle trend line would bring gold to the very notable resistance shelf (red) around 1500. Indeed, gold’s big picture could require an unsuccessful test there, a renewed decline to the rising lower line and then a bull breakout a year or two down the road. We just don’t know, so let’s not try to force it with our hopes and ideologies.

Gold Status: Several options, bullish and bearish. Use the small Sym-Tri upper and lower lines as parameters to bull or bear. These are the big picture technicals only. As with shorter-term charting, we manage the macro fundamentals consistently in NFTRH.

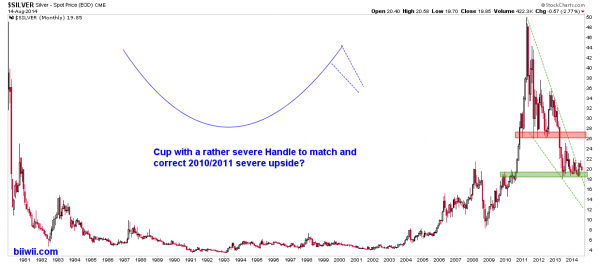

Here is a fun chart. There is no law that says a bullish Cup & Handle pattern cannot span decades just as there is no law that says a C&H must express itself bullishly. There is a law (in my personal view at least) that you respect parameters in a game where you can make or lose a lot of money depending upon whether you are on the right side of the trade or not.

In that regard, silver is clearly at a major support shelf after dropping from the right side of the Cup in something of a Falling Wedge. All of this is thought to be bullish. Further, silver broke out of the top of the Wedge and is now declining to test support again. That’s a parameter folks. As of now it is a parameter to the bull case. Success means get ready for some upside fireworks. Failure? Not so much.

The bullish target is the thick resistance shelf at around 26. A bearish objective if the major support parameter fails could be around 16 at the top of the Wedge. But again, we have these things called parameters. They are there to keep you in the game when the game is viable and out of it when it is not.

Silver Status: Declining anew to test support but still in bottoming and Wedge breakout mode. The noted support shelf formed by the 2009/2010 highs and the 2013/2014 lows is absolutely critical as a parameter.