Recently I've written about the head-scratching, never-ending, multi-decade decline in long-term interest rates (see chart below). Who cares? Well, just about anybody if you bear in mind the way interest rates impact the cost of borrowing on mortgages, credit cards, automobiles, corporate bonds, savings accounts and practically every other financial instrument you can imagine. Simplistic conventional thinking explains the race to 0% global interest rates by the loose monetary Quantitative Easing (QE) policies of the Federal Reserve. But validating that line of thinking becomes more challenging once you consider that QE ended months ago. And contrary to common belief, rates declined further rather than climb higher after QE’s completion.

Source: Calafia Beach Pundit

More specifically, if you look at rates during this same period last year, the yield on the 10-Year Treasury Note had more than doubled in the preceding 18 months to a level above 3%. The consensus view, then, was that QE's eventual wind-down would only add gasoline to the fire, causing bond prices to decline and rates to extend an indefinite upward march. Outside of bond guru Jeff Gundlach and a small minority of prognosticators, the herd was largely wrong – as is usually the case. As we sit here today, the 10-Year Note currently yields a paltry 2.26%, which has led to the long-bond iShares Barclays 20+ Year Treasury (ARCA:TLT) jumping +22% year-to-date (contrary to most expectations).

The American Ostrich

Like an ostrich sticking its head in the sand, many egocentric Americans tend to ignore details relating to others, especially if the analyzed data occurs outside their own borders. Unbeknownst to many, here are some key country interest rates below U.S. yields:

- Switzerland: 0.33%

- Japan: 0.34%

- Germany: 0.60%

- Finland 10-Year: 0.70%

- Austria: 0.75%

- France: 0.88%

- Denmark: 0.89%

- Sweden: 0.98%

- Ireland: 1.29%

- Spain: 1.69%

- Canada 1.80%

- UK: 1.85%

- Italy: 1.93%

- U.S.: 2.26% (are our rates really that low?)

Outside of Japan, these listed countries are not implementing QE (i.e., “Quantitative Easing”) as did the United States. Rather than QE being the main driver behind the multi-decade secular decline in interest rates, there are other more important disinflationary forces at work driving interest rates lower.

Technology, Globalization and Emerging Market Competition (T.G.E.M.)

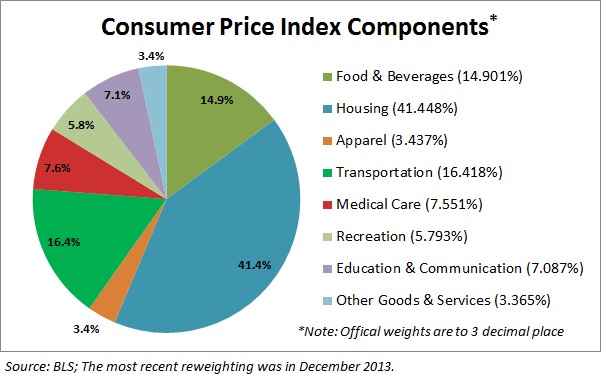

While tracking the endless monthly inflation statistics is a useful exercise to understand the tangible underlying pricing components of various industry segments (e.g., see 20 pages of CPI statistics), the larger and more important factors can be attributed to the somewhat more invisible elements of technology, globalization and emerging-marketcompetition (T.G.E.M).

Starting with technology, to put these dynamics into perspective, consider the number of transistors, or the effective horsepower, on a semiconductor (a.k.a. computer “chip”) today. The overall impact on global standards of living is nothing short of astounding. Take an Intel chip (NASDAQ:INTC) for example – it had approximately 2,000 transistors in 1971. Today, semiconductors can cram over 10,000,000,000 (yes billions – 5 million times more) transistors onto a single semiconductor. Anyone can look no further than their smartphone to understand the profound implications this has had not only on pricing in general, but society overall. To illustrate this point, I would direct you to a post highlighted by Professor Mark J. Perry, who observed the cost to duplicate an iPhone during 1991 would have been more than $3,500,000!

There are an infinite number of examples depicting how technology has accelerated the adoption of globalization. More recently, events such as the Arab Spring illustrate how Twitter (NYSE:TWTR) was used to displace costly military engagement alternatives. Even Chinese behemoth Alibaba Group's (NYSE:BABA) IPO illustrates the hunger that exists in emerging markets to join the highly effective economic system of global capitalism.

I think New York Times journalist Tom Friedman said it best in his book, The World is Flat, when he made the following observations about the dynamics occurring in emerging markets:

My mom told me to eat my dinner because there are starving children in China and India – I tell my kids to do their homework because Chinese and Indians are starving for their jobs.

France wants a 35 hour work week, India wants a 35 hour work day.

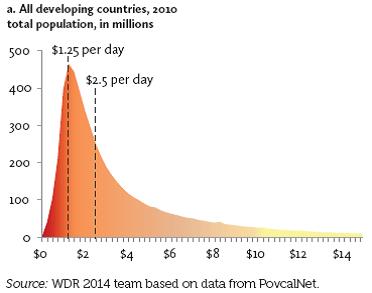

There may be a widening gap between rich and poor in the United States, but technology and globalization is narrowing that gap across the rest of the world. Consider that nearly half of the world’s population (3 billion+ people) live in poverty, earning less than $2.50 a day (see chart below). Technology and globalization is allowing this emerging middle class to climb the global economic ladder.

These impoverished individuals may not be imminently stealing our jobs and driving general prices lower, but their children -- and countless educated millions in other international markets -- are striving for the same economic security and prosperity that we have. The educated individuals in the emerging markets that have tasted capitalism are giving new meaning to the word “urgency”, which is only accelerating competition and global-pricing pressures. It comes as no surprise to me that this generational migration from the poor to the middle class is putting a lid on inflation and interest rates around the world.

Declining costs of human labor from emerging markets, however, is not the only issue putting a ceiling on general prices. Robotics, an area in which Sidoxia holds significant investments, continues to be an area of fascination. With human labor accounting for the majority of business costs, it’s no wonder that the C-suite is putting more investment dollars into automation. Rather than hire and train expensive workers, why not just buy a robot? And that's not just happening in the U.S. In fact the Chinese purchased more robots than Americans last year. And why not? An employer does not have to pay a robot, which never shows up late, never sues for discrimination or harassment, require no healthcare or retirement benefits and pretty much work 24 hours/day, 7 days/week and 365 days/year.

While the talking heads like to point to the simplistic explanation of loose, irresponsible monetary policies of global central banks as the reason behind a four-decade drop in interest rates, that's only a small part of the story. Investors and policy makers alike should be paying closer attention to the factors of technology, globalization and emerging-market competition as some of the more impactful dynamics systematically driving down long-term interest rates and inflation.