Owens-Illinois, Inc. (NYSE:OI) is scheduled to report second-quarter 2017 results after the market closes on Jul 31.

Last quarter, the company’s earnings beat the Zacks Consensus Estimate by 9.43%. Owens-Illinois surpassed the Zacks Consensus Estimate in each of the trailing four quarters, generating an average positive surprise of 5.92%.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

Owens-Illinois remains on track to achieve the company’s financial targets, including volume growth, margin, adjusted earnings, cash flow and deleveraging. In first-quarter 2017, the company began to deploy new customer relationship management tools which will help enhance effectiveness in customer service, increase its ability to grow with existing customers and develop new business.

Importantly, Owens-Illinois projects that sales volume in Brazil will begin to recover in second-quarter 2017. In Europe, sales volumes are projected to be flat in the second quarter, due, in part, the adjustment of the extra shipping day that benefited the first-quarter sales. Price/cost spread for Europe is likely to remain nearly flat through the rest of the year, a positive outcome since this has weighed on earnings over the last several years. Overall, the company anticipates higher earnings and margin expansion for Europe in second-quarter 2017.

However, Owens-Illinois remains concerned about the uncertainty in macroeconomic conditions and currency rates, as well as several other factors. Currency is expected to be a 1 cent headwind in the second quarter. The company’s results in the to-be-reported quarter might be a bit muted due to planned investments in the joint venture as well as in the core business.

Further, Owens-Illinois expects tax rate to be about 27% in the second quarter. This is substantially higher than the first-quarter rate and the rate reported in prior-year quarter and is expected to mar results in the quarter to be reported.

Earnings Whispers

Our proven model does not conclusively show that Owens-Illinois is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP: The Earnings ESP for Owens-Illinois is 0.00%. This is because the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at 67 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Owens-Illinois currently has a Zacks Rank #2 (Buy) which increases the predictive power of ESP. However, the company’s ESP of 0.00% makes surprise prediction difficult.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

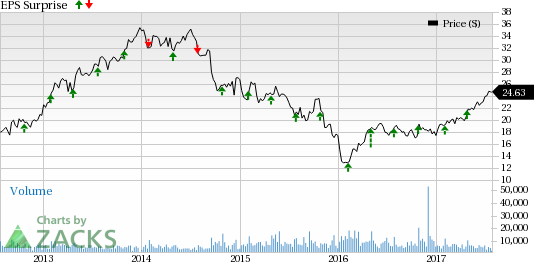

Share Price Performance

The company’s share price has outperformed its industry’s performance over the last one year. The current rate of return for the industry is 23.03%, while that of Owens-Illinois is 28.95%.

Stocks That Warrant a Look

Here are some stocks you may want to consider, as according to our model these have the right combination of elements to post an earnings beat this quarter.

AGCO Corporation (NYSE:AGCO) , with an Earnings ESP of +2.89% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere & Company (NYSE:DE) , with an Earnings ESP of +5.32% and a Zacks Rank #1.

AptarGroup, Inc. (NYSE:ATR) , with an Earnings ESP of +2.06% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Owens-Illinois, Inc. (OI): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post

Zacks Investment Research