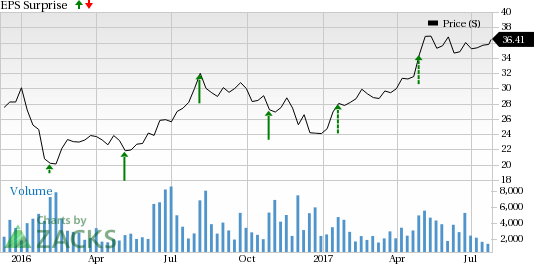

Atlassian Corporation Plc (NASDAQ:TEAM) is set to report fourth-quarter fiscal 2017 results on Jul 27. Last quarter, the company posted a positive earnings surprise of 50%. Notably, the stock outperformed the Zacks Consensus Estimate in all the trailing four quarters, with an average positive surprise of 70.8%.

Let’s see how things are shaping up for this announcement.

Factors at Play

Atlassian is engaged in designing, developing, licensing and maintenance of software, and provisioning of software hosting services. It offers tools for software developers consisting of FishEye, Bamboo and SourceTree.

During third-quarter fiscal 2017, the company acquired Trello – a cloud collaboration services provider – with more than 19 million users. This acquisition has not only strengthened Atlassian’s dominating position, but also enhanced its client base, which, we expect, will drive the company’s top- and bottom-line performances over the long run. We anticipate benefits of the acquisition to be reflected in the to-be-reported quarter results.

Furthermore, we believe that continuous investments in product development (mainly the launch of three purpose-built versions of JIRA products) and a significant number of customers on an active subscription or maintenance agreement are a few of the positives, which may drive the fiscal fourth-quarter results.

Nonetheless, a volatile spending atmosphere and competition from other privately held players in the space such as Dynport and PBworks remain concerns.

Earnings Whispers

Our proven model does not conclusively show that Atlassian is likely to beat the Zacks Consensus Estimate in its upcoming release. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. Unfortunately, this is not the case here as elaborated below.

Zacks ESP: The Earnings ESP for Atlassian is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 7 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Atlassian has a Zacks Rank #3. Though a Zacks Rank #1, 2 or 3 increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 and 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions momentum.

Stocks to Consider

Here are a few stocks, which you may consider as our model shows that these have the right combination of elements to post an earnings beat in the upcoming releases:

Cypress Semiconductor Corporation (NASDAQ:CY) , with an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Expedia, Inc. (NASDAQ:EXPE) , with an Earnings ESP of +16.67%, and a Zacks Rank #2.

PayPal Holdings, Inc. (NASDAQ:PYPL) , with an Earnings ESP of +3.13% and a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Expedia, Inc. (EXPE): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Original post

Zacks Investment Research