U.S. Silica Holdings, Inc. (NYSE:SLCA) is set to release second-quarter 2017 results after the closing bell on Jul 31.

Last quarter, the company delivered a profit of $2.5 million or 3 cents per share, against a net loss of $11 million or 20 cents in the prior-year quarter. Barring costs related to business development and restructuring, U.S. Silica’s adjusted earnings came in at 9 cents per share in the quarter, topping the Zacks Consensus Estimate of 6 cents.

Revenues doubled year over year to $244.8 million in the reported quarter. The figure surpassed the Zacks Consensus Estimate of $227 million. Overall sales volume jumped 49% year over year in the quarter to 3.4 million tons.

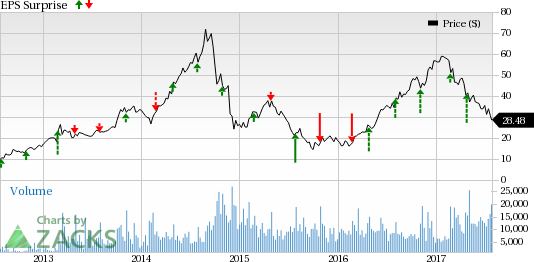

U.S. Silica surpassed the Zacks Consensus Estimate in the trailing four quarters with an average positive surprise of 29.42%.

U.S. Silica has lost 31.4% of its value in the last three months versus the 10.8% gain of its industry.

Can the company surprise investors again or is it heading for a possible pullback? Let’s see how things are shaping up for this announcement.

Factors at Play

U.S. Silica, in its first-quarter call, announced that it expects healthy demand for its Oil and Gas products in the second quarter. Revenues for the Oil & Gas division aggregated to $193 million in the first quarter, a roughly two-and-a-half-fold year-over-year surge. Overall sales volume soared 79% in the quarter to 2.5 million tons from 1.4 million tons sold in the prior-year quarter.

U.S. Silica remains focused on pursuing acquisitions of complementary businesses or assets. The company continues to evaluate opportunities for greenfield expansions in the Permian Basin and is also expanding production capacities and efficiencies across some of its existing facilities. The company is also executing many cost improvement projects throughout its supply chain.

U.S. Silica acquired logistics solutions provider, Sandbox Enterprises LLC. This acquisition will enable the company to offer customers improved transportation and operating efficiencies and meaningful cost savings relative to the existing delivery systems. The acquisition is also expected to deliver earnings accretion between 20 cents and 30 cents per share in 2017.

U.S. Silica also purchased a unit of National Coatings Corp. that makes and markets cool roof granules used in industrial roofing systems. The acquisition has allowed U.S. Silica to enter into a new and growing market and expand its offerings under its new product development initiative.

However, the low oil price environment poses a headwind for U.S. Silica. Oil prices remain under pressure amid a persistently oversupplied market. Ramp up of production by U.S. shale drillers is putting downward pressure on oil prices.

Earnings Whispers

Our proven model does not conclusively show that U.S. Silica is likely to beat the Zacks Consensus Estimate this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Earnings ESP for U.S. Silica is currently pegged at -5.56%. This is because the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 34 cents and 36 cents, respectively. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: U.S. Silica currently carries a Zacks Rank #3, which when combined with a negative ESP, makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

Note that we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks Poised to Beat Estimates

Here are some companies in the basic materials space you may want to consider as our model shows these have the right combination of elements to post an earnings beat this quarter:

The Chemours Company (NYSE:CC) has an Earnings ESP of +4.44% and a Zacks Rank #2.

Westlake Chemical Corporation (NYSE:WLK) has an Earnings ESP of +5.04% and a Zacks Rank #2.

Iamgold Corporation (TO:IAG) has an Earnings ESP of +300.00% and carries a Zacks Rank #3.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Chemours Company (The) (CC): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Iamgold Corporation (IAG (LON:ICAG)): Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA): Free Stock Analysis Report

Original post

Zacks Investment Research