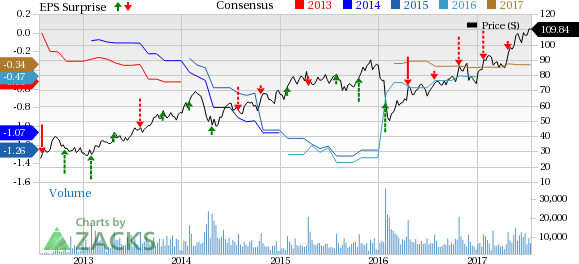

ServiceNow Inc. (NYSE:NOW) is set to release second-quarter 2017 earnings on Jul 26. The company has missed the Zacks Consensus Estimate in all the trailing four quarters, with an average negative surprise of 31.54%.

Last quarter, the company reported a loss (including stock based compensation) of 18 cents per share, wider than the Zacks Consensus Estimate of a loss of 16 cents.

However, revenues of almost $424 million surged 38.6% year over year to beat the Zacks Consensus Estimate of $409 million. ServiceNow won 28 new deals greater than $1 million in net new annualized contract value (ACV), and 26 net new Global 2K customers. Renewal rate was 97% in the reported quarter.

The shares have massively outperformed the industry on a year-to-date basis. While the industry gained 21.3%, the stock returned 47.8%. We believe that the company’s expanding product portfolio, increasing multi-product customer base and strong renewal rate are the key growth drivers.

Let’s see how things are shaping up for this announcement.

Factors to Consider

ServiceNow enjoys a dominant position in the IT Service Market (ITSM) and IT Operations Market (ITOM). The company is also penetrating the non-ITSM markets like human resource and security solutions by launching new products and services. The size of its total addressable market is increasing given the rise in G2K as well as non-G2K customer base.

Moreover, the company is going in for strategic acquisitions in order to innovate and expand its product portfolio, which in turn is expected to accelerate revenues.

However, ServiceNow faces stiff competition in the non-ITSM market from well-established players like Oracle (NYSE:ORCL) and salesforce.com. Its lack of exposure to a growing economy like China remains an overhang. Modest growth in professional service business is another headwind.

The company has also been incurring losses over a period of time. Thus, price control in order to stay competitive in the market will weigh heavily on its top line.

Earnings Whispers

Our proven model does not conclusively show that ServiceNow is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: ServiceNow’s Earnings ESP is 0.00%. This is because both the Most Accurate estimate and Zacks Consensus Estimate stand at a loss of 18 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter

Zacks Rank: ServiceNow carries a Zacks Rank #3, which when combined with a 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 and 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies that, as per our model, have the right combination of elements to post an earnings beat this quarter:

Cypress Semiconductor Corporation (NASDAQ:CY) with an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

CGI Group, Inc. (NYSE:GIB) with an Earnings ESP of +5.71% and a Zacks Rank #1.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

ServiceNow, Inc. (NOW): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

CGI Group, Inc. (GIB): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Original post

Zacks Investment Research