Texas Instruments Inc. (NASDAQ:TXN) or TI, a global semiconductor company and one of the world's leading designers and suppliers of digital signal processors and analog integrated circuits, is slated to report second-quarter 2017 results on Jul 25.

The company has a Zacks Rank #3 (Hold) and an Earnings ESP of 0.00%, a combination that makes surprise prediction difficult. This is because, per our proven model, a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 to beat estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

We don’t recommend Sell-rated stocks (Zacks Rank #4 or #5) going into the earnings announcement.

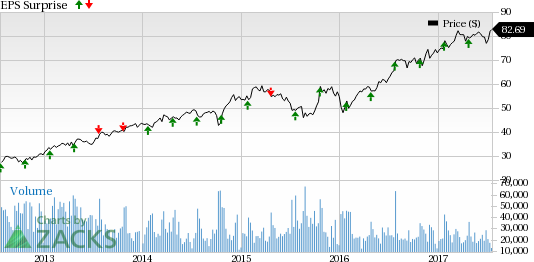

Texas Instruments’ surprise history has been quite impressive as the company beat estimates in each of the last four quarters with an average positive surprise of 7.68%.

In the last one year, the stock has underperformed the industry it belongs to. It gained 24.8% compared with the industry’s gain of 35.3%.

First-Quarter Highlights

In the quarter, Texas Instruments’ revenues grew 13.1% year over year. Pro forma net income was up 40.6% from the year-ago period.

The automotive market continued to be strong. The company also saw broad-based improvement in the industrial market. The communications market and personal electronics grew well. Enterprise systems saw a decline.

The analog and embedded processing applications business displayed strong growth.

Factors at Play this Quarter

Internal Execution Remains the Key

Internally, the company has always executed rather well. It, along with chipmaker Intel (NASDAQ:INTC), remains one of the few semiconductor companies that depend on internal capacity for manufacturing the bulk of its devices. Since the company usually builds out capacity well ahead of demand, it is able to make opportunistic purchases. As a result, it is able to contain capex at up to 4% of sales even while on an expansion plan.

Texas Instruments Incorporated Price and EPS Surprise

Investments in High Margin Areas

Texas Instruments continues to prudently invest its R&D dollars into several high-margin, high-growth areas of the analog and embedded processing markets. This is gradually increasing its exposure to the industrial and automotive markets and increasing dollar content at customers, while reducing its exposure to volatile consumer/computing markets.

Auto and Industrial Markets Strong

There are indications of strengthening auto and industrial markets, which are helping the company. The communications and enterprise systems market is stable. The personal electronics market remains weak.

To Conclude

We remain optimistic about TI’s compelling product line, the differentiation in its business and lower-cost 300mm Analog output. We note that channel inventories remain very low, meaning that demand is likely to remain strong.

Stocks to Consider

Here are some stocks that you may want to consider as our model shows these have the right combination of elements to post a positive earnings surprise:

Cypress Semiconductor Corporation (NASDAQ:CY) , with an Earnings ESP of +11.11% and Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research Corporation (NASDAQ:LRCX) , with an Earnings ESP of +1.33% and a Zacks Rank #1.

The Priceline Group Inc. (NASDAQ:PCLN) , with an Earnings ESP of +2.31% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

The Priceline Group Inc. (PCLN): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post