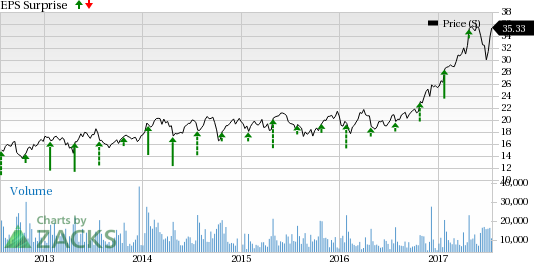

Teradyne Inc. (NYSE:TER) is slated to report second-quarter 2017 results on July 26. In the last-reported quarter, Teradyne delivered a positive earnings surprise of 15.79%.

Coming to the share price movement, Teradyne’s shares have returned only 39.1% year to date, outperforming the industry’s gain of 18.5%.

Let’s see how things are shaping up for this announcement.

Factors to Consider

Teradyne posted strong fourth-quarter results, surpassing the Zacks Consensus Estimate on both counts. Teradyne’s earnings were backed by higher-than-expected revenues which came above the Zacks Consensus Estimate of $439.2 million and management’s guided range of $420–$450 million.

Pro forma gross margin was 58%, up 56 basis points (bps) sequentially due to higher revenues and a favorable mix.

The popularity of its products, acquisitions of LitePoint and Universal Robots and continuous design wins are expected to drive Teradyne’s results in the to-be reported quarter. However, weakness in a few end markets could be a headwind.

For the second quarter, management expects revenues in the range of $660–$700 million, reflecting an increase of 48.7% sequentially at the mid-point. Non-GAAP earnings per share from continuing operations are likely to be in the range of 81–90 cents. GAAP earnings are expected in the range of 77–86 cents.

Earnings Whispers

Our proven model does not conclusively show that Teradyne will beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1, 2 or 3 for this to happen. That is not the case here, as you will see below.

Zacks ESP:The Most Accurate estimate stands at 88 cents while the Zacks Consensus Estimate is pegged at 86 cents. Hence, the difference is +2.33%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Although the company has a positive earnings ESP, Teradyne carries a Zacks Rank #4 (Sell).

We caution against stocks with Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

You may consider the following stocks with a positive Earnings ESP and a favorable Zacks Rank.

Cypress Semiconductor Corporation (NASDAQ:CY) , with an Earnings ESP of +11.11% and Zacks Rank #1 (Stong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research Corporation (NASDAQ:LRCX) , with an Earnings ESP of +1.33% and a Zacks Rank #1.

Fortive Corporation (NYSE:FTV) , with an Earnings ESP of +2.90% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Teradyne, Inc. (TER): Free Stock Analysis Report

Fortive Corporation (FTV): Free Stock Analysis Report

Original post

Zacks Investment Research