Equity Residential (NYSE:EQR) is slated to report second-quarter 2017 results after the market closes on Jul 25.

Last quarter, this Chicago, IL-based residential real estate investment trust (“REIT”) delivered an in-line result. Results reflected enhanced same-store net operating income (NOI) and lease-up NOI. In addition, the company experienced lower corporate overhead. However, the positive was offset by adverse impact on NOI, primarily stemming from the company’s 2016 huge disposition activity.

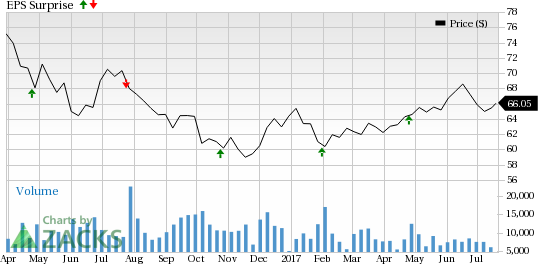

Moreover, the company met estimates in three occasions and missed in the other, over the trailing four quarters. This resulted in an average negative surprise of 0.33%. The graph below depicts the surprise history of the company.

Let’s see how things are shaping up for Equity Residential prior to this announcement.

Factors to Consider

Equity Residential is poised to benefit from its portfolio-repositioning efforts, household growth, favorable demographics, lifestyle transformation and low unemployment. The company made concerted efforts toward repositioning the portfolio from low barrier-to-entry/non-core markets to high barrier-to-entry/core markets, and opted for substantial sale out of its portfolio in 2016.

The company’s current focus is on the acquisition and development of assets mainly in six core coastal metropolitan areas – Boston, New York, Washington D.C., Southern California (including Los Angeles, Orange County and San Diego), San Francisco and Seattle. Also, there is solid rental demand through the nation’s coastal, gateway cities. As such, its performance in the to-be-reported quarter is likely to reflect positive impact from same-store and lease up NOI.

However, there is increasing new apartment supply in a number of the company’s markets. Amid this, pressure on new lease rates is expected to continue, while concession activity is anticipated to remain elevated.

In addition, though the assets sale might enable the company focus exclusively on its core, high-density urban markets over the long term, the earnings dilution impact from such a move cannot be bypassed in the near term. These issues are anticipated to affect the company’s net operating income in the quarter to be reported.

For second-quarter 2017, Equity Residential projects normalized funds from operations (“FFO”) per share in the range of 75–79 cents. The Zacks Consensus Estimate for the same is currently pegged at 77 cents.

Equity Residential’s activities during the quarter failed to gain analysts’ confidence. Consequently, the Zacks Consensus Estimate remained unchanged over the last 30 days.

Further, year-to-date, shares of Equity Residential underperformed the Zacks categorized REIT and Equity Trust – Residential industry. The company’s shares logged in a return of 4.4%, against 6.3% growth of the industry.

Earnings Whispers

Our proven model does not conclusively show that Equity Residential will likely beat on estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: The Earnings ESP for Equity Residential is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 77 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Equity Residential’s Zacks Rank #2 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident of an earnings beat.

Conversely, we caution against stocks with Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that they have the right combination of elements to report a positive surprise this quarter:

Liberty Property Trust (NYSE:LPT) , slated to release second-quarter results on Jul 25, has an Earnings ESP of +1.61% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

CyrusOne Inc. (NASDAQ:CONE) , scheduled to release earnings on Aug 2, has a Zacks Rank #2 and an Earnings ESP of +2.70%.

Piedmont Office Realty Trust, Inc. (NYSE:PDM) , slated to release earnings on Aug 2, has an Earnings ESP of +2.27% and a Zacks Rank #3.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Equity Residential (EQR): Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Liberty Property Trust (LPT): Free Stock Analysis Report

Original post