Endocyte, Inc. (NASDAQ:ECYT) is expected to report second-quarter 2017 results on Aug 3.

The company has a mixed track record, having beaten the Zacks Consensus Estimate in three of the trailing four quarters and missing the same in the remaining quarter. Overall, the company delivered an average positive surprise of 6.41%.

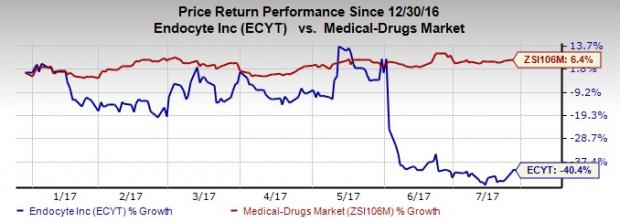

Notably, Endocyte’s has lost 40.4% of its value year to date versus the 6.4% growth of its industry.

The company exceeded expectations by 3.57% in the last reported quarter. Let's see how things are shaping up for this quarter.

Factors at Play

Endocyte is a development-stage biopharmaceutical company, focused on bringing targeted therapies for the treatment of cancer and inflammatory diseases to market.

In Jun 2017, Endocyte announced plans to reduce its workforce by about 40% in order to better focus its resources on the more valuable opportunities. The company also looks forward to shift its focus on its most promising programs, which include its CAR T-cell small-molecule drug conjugates (SMDCs) adaptor platform, the dual-targeted DNA crosslinker drug EC2629.

In March, Endocyte disclosed its plan to collaborate with Seattle Children's Research Institute and Dr. Michael Jensen for the development of its SMDC platform in the chimeric antigen receptor T-cell (CAR T-cell) immunotherapy setting, through the use of its proprietary SMDC bi-specific adaptor molecules. Pre-clinical evaluations for the CAR T-cell program are expected to be completed in the second half of 2017, in anticipation of a potential Investigational New Drug (IND) filing in 2018.

Currently, the company is evaluating EC1169 in a phase I study for metastatic castration-resistant prostate cancer (mCRPC) in taxane-exposed patients. The patients are being scanned with its companion imaging agent, EC0652, to identify the presence of prostate-specific membrane antigen. A top-line efficacy assessment of the expansion phase of this phase I trial is expected before the end of 2017.

We note that EC1456 is being evaluated in a small number of patients in an ovarian cancer surgical study.

Additionally, this biopharmaceutical company is nearing completion of preclinical work required to file an Investigational New Drug (IND) application for EC2629, which is the company’s first candidate to target disease cells and simultaneously impact the tumor micro environment by shutting down tumors associated with macrophages. The company expects to file an IND for EC2629 in 2017.

Earnings Whispers

Our proven model does not conclusively show earnings beat for Endocyte this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat estimates. But that is not the case here, as you will see below.

Zacks ESP: Endocyte’s has an Earnings ESP of 0.00% as the Most Accurate estimate is in line with the Zacks Consensus Estimate loss of 25 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

.Zacks Rank: Endocyte's carries a Zacks Rank #2, which when combined with its 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with Zacks Ranks #4 or 5 (Sell rated) going into an earnings announcement, especially when the company is seeing a negative estimate revision.

Stocks to Consider

Here are some health care stocks that you may want to consider, as our model shows that it has the right combination of elements to post an earnings beat this quarter.

Agenus Inc. (NASDAQ:AGEN) has an Earnings ESP of +5.56% and a Zacks Rank #1. The company is expected to release results on Jul 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Clovis Oncology, Inc. (NASDAQ:CLVS) has an Earnings ESP of +6.30% and a Zacks Rank #3. The company is scheduled to release results on Aug 2.

Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT) has an Earnings ESP of +9.39% and a Zacks Rank #3. The company is expected to release results on Aug 3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Agenus Inc. (AGEN): Free Stock Analysis Report

Clovis Oncology, Inc. (CLVS): Free Stock Analysis Report

Intercept Pharmaceuticals, Inc. (ICPT): Free Stock Analysis Report

Endocyte, Inc. (ECYT): Free Stock Analysis Report

Original post

Zacks Investment Research